It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. This was the case with hedge funds, who we heard were pulling money from the market amid the volatility, which included money from small-cap stocks, which they invest in at a higher rate than other investors. This action contributed to the greater decline in these stocks during the tumultuous period. We will study how this market volatility affected their sentiment towards Aerie Pharmaceuticals Inc (NASDAQ:AERI) during the quarter below.

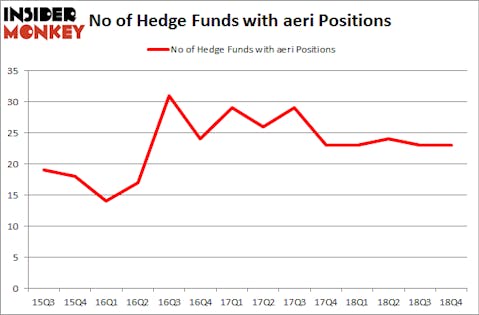

Aerie Pharmaceuticals Inc (NASDAQ:AERI) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 23 hedge funds’ portfolios at the end of the fourth quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Arcos Dorados Holding Inc (NYSE:ARCO), Scientific Games Corp (NASDAQ:SGMS), and Evolent Health Inc (NYSE:EVH) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a gander at the key hedge fund action encompassing Aerie Pharmaceuticals Inc (NASDAQ:AERI).

What does the smart money think about Aerie Pharmaceuticals Inc (NASDAQ:AERI)?

At Q4’s end, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 23 hedge funds with a bullish position in AERI a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

More specifically, Adage Capital Management was the largest shareholder of Aerie Pharmaceuticals Inc (NASDAQ:AERI), with a stake worth $113.6 million reported as of the end of December. Trailing Adage Capital Management was Healthcor Management LP, which amassed a stake valued at $88.8 million. Foresite Capital, Partner Fund Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Aerie Pharmaceuticals Inc (NASDAQ:AERI) has witnessed a decline in interest from the entirety of the hedge funds we track, it’s easy to see that there exists a select few hedge funds that elected to cut their entire stakes heading into Q3. At the top of the heap, Steve Cohen’s Point72 Asset Management cut the largest stake of the “upper crust” of funds watched by Insider Monkey, worth about $12.5 million in call options, and Israel Englander’s Millennium Management was right behind this move, as the fund said goodbye to about $6.1 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Aerie Pharmaceuticals Inc (NASDAQ:AERI) but similarly valued. We will take a look at Arcos Dorados Holding Inc (NYSE:ARCO), Scientific Games Corp (NASDAQ:SGMS), Evolent Health Inc (NYSE:EVH), and Endo International plc (NASDAQ:ENDP). This group of stocks’ market valuations are similar to AERI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARCO | 14 | 155551 | -4 |

| SGMS | 26 | 549206 | 1 |

| EVH | 14 | 107531 | 1 |

| ENDP | 23 | 269495 | 1 |

| Average | 19.25 | 270446 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $270 million. That figure was $628 million in AERI’s case. Scientific Games Corp (NASDAQ:SGMS) is the most popular stock in this table. On the other hand Arcos Dorados Holding Inc (NYSE:ARCO) is the least popular one with only 14 bullish hedge fund positions. Aerie Pharmaceuticals Inc (NASDAQ:AERI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately AERI wasn’t nearly as popular as these 15 stock and hedge funds that were betting on AERI were disappointed as the stock returned 6.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.