Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter of 2018. Trends reversed 180 degrees in 2019 amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the third quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards WestRock Company (NYSE:WRK).

Hedge fund interest in WestRock Company (NYSE:WRK) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Targa Resources Corp (NYSE:TRGP), Iron Mountain Incorporated (NYSE:IRM), and FactSet Research Systems Inc. (NYSE:FDS) to gather more data points. Our calculations also showed that WRK isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are dozens of gauges investors can use to evaluate publicly traded companies. Two of the most useful gauges are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the elite money managers can outclass the S&P 500 by a significant margin (see the details here).

David E. Shaw of D.E. Shaw

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a gander at the latest hedge fund action surrounding WestRock Company (NYSE:WRK).

What does smart money think about WestRock Company (NYSE:WRK)?

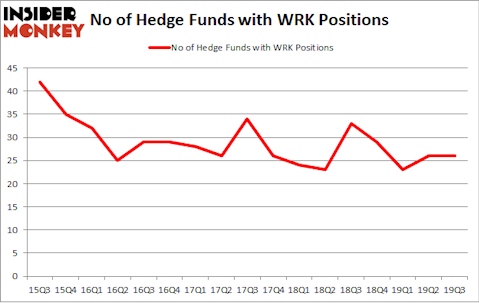

At the end of the third quarter, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 33 hedge funds with a bullish position in WRK a year ago. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Citadel Investment Group was the largest shareholder of WestRock Company (NYSE:WRK), with a stake worth $149.9 million reported as of the end of September. Trailing Citadel Investment Group was Millennium Management, which amassed a stake valued at $137.2 million. Impax Asset Management, Lakewood Capital Management, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Lakewood Capital Management allocated the biggest weight to WestRock Company (NYSE:WRK), around 2.69% of its portfolio. Impax Asset Management is also relatively very bullish on the stock, earmarking 1.38 percent of its 13F equity portfolio to WRK.

Seeing as WestRock Company (NYSE:WRK) has faced a decline in interest from the aggregate hedge fund industry, it’s safe to say that there was a specific group of fund managers that slashed their positions entirely in the third quarter. It’s worth mentioning that Thomas E. Claugus’s GMT Capital sold off the biggest stake of the 750 funds monitored by Insider Monkey, worth close to $10.7 million in stock. Matthew Hulsizer’s fund, PEAK6 Capital Management, also sold off its stock, about $3.9 million worth. These moves are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to WestRock Company (NYSE:WRK). These stocks are Targa Resources Corp (NYSE:TRGP), Iron Mountain Incorporated (NYSE:IRM), FactSet Research Systems Inc. (NYSE:FDS), and National Retail Properties, Inc. (NYSE:NNN). This group of stocks’ market values are similar to WRK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TRGP | 16 | 241333 | -2 |

| IRM | 14 | 58210 | 0 |

| FDS | 19 | 262033 | 0 |

| NNN | 20 | 275561 | 4 |

| Average | 17.25 | 209284 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $209 million. That figure was $606 million in WRK’s case. National Retail Properties, Inc. (NYSE:NNN) is the most popular stock in this table. On the other hand Iron Mountain Incorporated (NYSE:IRM) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks WestRock Company (NYSE:WRK) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on WRK as the stock returned 11.9% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.