Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 2.5 months of this year the Standard and Poor’s 500 Index returned approximately 13.1% (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only 5% due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns (5%) versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like Kaman Corporation (NYSE:KAMN).

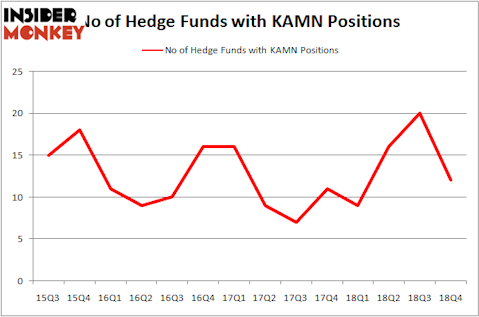

Is Kaman Corporation (NYSE:KAMN) an exceptional investment now? Prominent investors are in a bearish mood. The number of long hedge fund positions fell by 8 lately. Our calculations also showed that KAMN isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of formulas stock market investors can use to analyze stocks. A duo of the most useful formulas are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the elite hedge fund managers can outpace the S&P 500 by a superb amount (see the details here).

Let’s take a peek at the latest hedge fund action regarding Kaman Corporation (NYSE:KAMN).

How are hedge funds trading Kaman Corporation (NYSE:KAMN)?

At Q4’s end, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of -40% from one quarter earlier. By comparison, 9 hedge funds held shares or bullish call options in KAMN a year ago. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

The largest stake in Kaman Corporation (NYSE:KAMN) was held by GAMCO Investors, which reported holding $159.8 million worth of stock at the end of December. It was followed by Cardinal Capital with a $50.4 million position. Other investors bullish on the company included Levin Capital Strategies, D E Shaw, and GLG Partners.

Since Kaman Corporation (NYSE:KAMN) has witnessed a decline in interest from hedge fund managers, logic holds that there lies a certain “tier” of fund managers that slashed their full holdings by the end of the third quarter. At the top of the heap, Israel Englander’s Millennium Management said goodbye to the biggest position of the “upper crust” of funds tracked by Insider Monkey, totaling about $8.2 million in stock, and Howard Marks’s Oaktree Capital Management was right behind this move, as the fund dropped about $6.9 million worth. These transactions are important to note, as total hedge fund interest fell by 8 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Kaman Corporation (NYSE:KAMN) but similarly valued. We will take a look at Bed Bath & Beyond Inc. (NASDAQ:BBBY), Arch Coal, Inc. (NYSE:ARCH), Varonis Systems Inc (NASDAQ:VRNS), and Ensco Rowan plc (NYSE:ESV). This group of stocks’ market valuations resemble KAMN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBBY | 30 | 197296 | 2 |

| ARCH | 25 | 345870 | -1 |

| VRNS | 21 | 138429 | -1 |

| ESV | 34 | 291967 | 5 |

| Average | 27.5 | 243391 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.5 hedge funds with bullish positions and the average amount invested in these stocks was $243 million. That figure was $258 million in KAMN’s case. Ensco Rowan plc (NYSE:ESV) is the most popular stock in this table. On the other hand Varonis Systems Inc (NASDAQ:VRNS) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks Kaman Corporation (NYSE:KAMN) is even less popular than VRNS. Hedge funds dodged a bullet by taking a bearish stance towards KAMN. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately KAMN wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); KAMN investors were disappointed as the stock returned 8.3% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.