The financial regulations require hedge funds and wealthy investors that exceeded the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31st, about a week after the S&P 500 Index bottomed. We at Insider Monkey have made an extensive database of more than 821 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded GreenSky, Inc. (NASDAQ:GSKY) based on those filings.

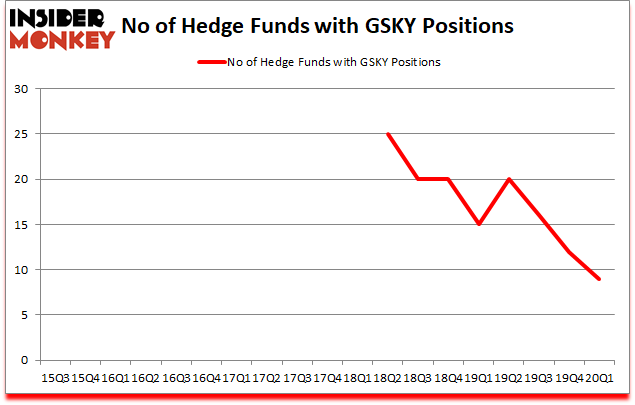

GreenSky, Inc. (NASDAQ:GSKY) has experienced a decrease in hedge fund interest in recent months. Our calculations also showed that GSKY isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Today there are tons of formulas shareholders use to grade publicly traded companies. Two of the best formulas are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the best hedge fund managers can outperform the S&P 500 by a healthy margin (see the details here).

Paul Reeder of PAR Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, We take a look at lists like the 10 most profitable companies in the world to identify the compounders that are likely to deliver double digit returns. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s take a gander at the latest hedge fund action regarding GreenSky, Inc. (NASDAQ:GSKY).

How have hedgies been trading GreenSky, Inc. (NASDAQ:GSKY)?

At the end of the first quarter, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -25% from the previous quarter. The graph below displays the number of hedge funds with bullish position in GSKY over the last 18 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Phill Gross and Robert Atchinson’s Adage Capital Management has the largest position in GreenSky, Inc. (NASDAQ:GSKY), worth close to $3.7 million, comprising less than 0.1%% of its total 13F portfolio. On Adage Capital Management’s heels is D E Shaw, led by D. E. Shaw, holding a $3.1 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions encompass Daryl Smith’s Kayak Investment Partners, Israel Englander’s Millennium Management and Paul Reeder and Edward Shapiro’s PAR Capital Management. In terms of the portfolio weights assigned to each position Kayak Investment Partners allocated the biggest weight to GreenSky, Inc. (NASDAQ:GSKY), around 1.11% of its 13F portfolio. PAR Capital Management is also relatively very bullish on the stock, dishing out 0.06 percent of its 13F equity portfolio to GSKY.

Because GreenSky, Inc. (NASDAQ:GSKY) has witnessed falling interest from hedge fund managers, it’s safe to say that there is a sect of hedge funds that slashed their entire stakes in the first quarter. It’s worth mentioning that Mendel Hui’s Isomer Partners dropped the biggest investment of all the hedgies monitored by Insider Monkey, comprising about $6.1 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace LLP, also dumped its stock, about $0.3 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 3 funds in the first quarter.

Let’s check out hedge fund activity in other stocks similar to GreenSky, Inc. (NASDAQ:GSKY). These stocks are Associated Capital Group, Inc. (NYSE:AC), Amphastar Pharmaceuticals Inc (NASDAQ:AMPH), NextGen Healthcare, Inc. (NASDAQ:NXGN), and Partner Communications Company Ltd (NASDAQ:PTNR). This group of stocks’ market valuations match GSKY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AC | 6 | 53890 | 0 |

| AMPH | 6 | 19619 | 0 |

| NXGN | 21 | 26574 | 5 |

| PTNR | 1 | 9964 | -1 |

| Average | 8.5 | 27512 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $28 million. That figure was $15 million in GSKY’s case. NextGen Healthcare, Inc. (NASDAQ:NXGN) is the most popular stock in this table. On the other hand Partner Communications Company Ltd (NASDAQ:PTNR) is the least popular one with only 1 bullish hedge fund positions. GreenSky, Inc. (NASDAQ:GSKY) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.4% in 2020 through June 22nd but still beat the market by 15.9 percentage points. Hedge funds were also right about betting on GSKY as the stock returned 33.5% in Q2 (through June 22nd) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Greensky Inc. (NASDAQ:GSKY)

Follow Greensky Inc. (NASDAQ:GSKY)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.