At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). We reversed our stance on March 25th after seeing unprecedented fiscal and monetary stimulus unleashed by the Fed and the Congress. This is the perfect market for stock pickers, now that the stocks are fully valued again. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Visa Inc (NYSE:V) at the end of the second quarter and determine whether the smart money was really smart about this stock.

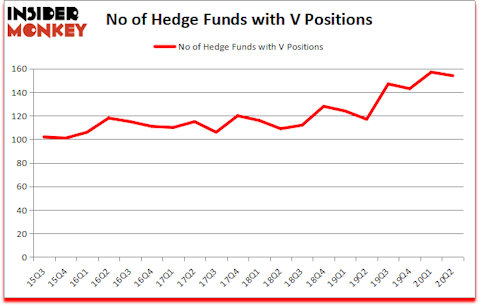

Visa Inc (NYSE:V) shareholders have witnessed a decrease in support from the world’s most elite money managers of late. Hedge fund sentiment towards Visa was at its all time high at the end of March, so this is a small step back from that. Our calculations also showed that V ranked #6 among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are several formulas investors have at their disposal to evaluate stocks. A pair of the less known formulas are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the elite investment managers can outperform the market by a superb margin (see the details here).

Jacob Rothschild of RIT Capital

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, legal marijuana is one of the fastest growing industries right now, so we are checking out ideas like this under-the-radar stock to identify the next tenbagger. Currently, investors are pessimistic about commercial real estate investments. So, we are checking out this contrarian play to diversify our market exposure. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. Now let’s view the latest hedge fund action regarding Visa Inc (NYSE:V).

How are hedge funds trading Visa Inc (NYSE:V)?

Heading into the third quarter of 2020, a total of 154 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -2% from one quarter earlier. By comparison, 117 hedge funds held shares or bullish call options in V a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

More specifically, Fisher Asset Management was the largest shareholder of Visa Inc (NYSE:V), with a stake worth $4052.6 million reported as of the end of September. Trailing Fisher Asset Management was Berkshire Hathaway, which amassed a stake valued at $1929.3 million. Akre Capital Management, GQG Partners, and Arrowstreet Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Truvvo Partners allocated the biggest weight to Visa Inc (NYSE:V), around 30.17% of its 13F portfolio. Hengistbury Investment Partners is also relatively very bullish on the stock, earmarking 30.16 percent of its 13F equity portfolio to V.

Judging by the fact that Visa Inc (NYSE:V) has experienced a decline in interest from the smart money, it’s easy to see that there was a specific group of funds that elected to cut their full holdings heading into Q3. Intriguingly, Renaissance Technologies said goodbye to the biggest stake of the 750 funds tracked by Insider Monkey, valued at an estimated $129.3 million in stock. Glen Kacher’s fund, Light Street Capital, also sold off its stock, about $29.4 million worth. These moves are interesting, as total hedge fund interest dropped by 3 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Visa Inc (NYSE:V) but similarly valued. We will take a look at Johnson & Johnson (NYSE:JNJ), Walmart Inc. (NYSE:WMT), JPMorgan Chase & Co. (NYSE:JPM), The Procter & Gamble Company (NYSE:PG), Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM), Mastercard Incorporated (NYSE:MA), and UnitedHealth Group Inc. (NYSE:UNH). All of these stocks’ market caps match V’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JNJ | 94 | 4731250 | 12 |

| WMT | 60 | 5829223 | 5 |

| JPM | 123 | 8732467 | 11 |

| PG | 73 | 9244143 | -4 |

| TSM | 58 | 5209772 | 4 |

| MA | 147 | 14350337 | 8 |

| UNH | 96 | 8326373 | -8 |

| Average | 93 | 8060509 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 93 hedge funds with bullish positions and the average amount invested in these stocks was $8.1 billion. That figure was $17 billion in V’s case. Mastercard Incorporated (NYSE:MA) is the most popular stock in this table. On the other hand Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM) is the least popular one with only 58 bullish hedge fund positions. Compared to these stocks Visa Inc (NYSE:V) is more popular among hedge funds. Our overall hedge fund sentiment score for V is 96.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 28.2% in 2020 through August 24th and still beat the market by 20.6 percentage points. Unfortunately V wasn’t nearly as successful as these 10 stocks and hedge funds that were betting on V were disappointed as the stock returned 7% since the end of the second quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Visa Inc. (NYSE:V)

Follow Visa Inc. (NYSE:V)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.