We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (read our latest 10 coronavirus predictions).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Quest Diagnostics Incorporated (NYSE:DGX).

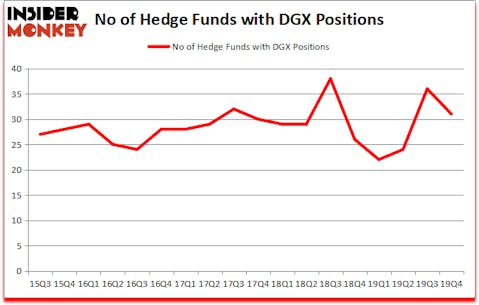

Quest Diagnostics Incorporated (NYSE:DGX) was in 31 hedge funds’ portfolios at the end of the fourth quarter of 2019. DGX has experienced a decrease in activity from the world’s largest hedge funds of late. There were 36 hedge funds in our database with DGX positions at the end of the previous quarter. Our calculations also showed that DGX isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

In the financial world there are dozens of gauges stock market investors put to use to analyze stocks. Two of the most innovative gauges are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the elite money managers can outperform the S&P 500 by a very impressive margin (see the details here).

Philippe Laffont of Coatue Management

We leave no stone unturned when looking for the next great investment idea. For example we recently identified a stock that trades 25% below the net cash on its balance sheet. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to go over the recent hedge fund action encompassing Quest Diagnostics Incorporated (NYSE:DGX).

How have hedgies been trading Quest Diagnostics Incorporated (NYSE:DGX)?

At Q4’s end, a total of 31 of the hedge funds tracked by Insider Monkey were long this stock, a change of -14% from the third quarter of 2019. By comparison, 26 hedge funds held shares or bullish call options in DGX a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Paul Marshall and Ian Wace’s Marshall Wace LLP has the largest position in Quest Diagnostics Incorporated (NYSE:DGX), worth close to $75.4 million, corresponding to 0.5% of its total 13F portfolio. Coming in second is Two Sigma Advisors, led by John Overdeck and David Siegel, holding a $53.4 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions consist of Bernard Horn’s Polaris Capital Management, John W. Rogers’s Ariel Investments and Cliff Asness’s AQR Capital Management. In terms of the portfolio weights assigned to each position Tamarack Capital Management allocated the biggest weight to Quest Diagnostics Incorporated (NYSE:DGX), around 5.88% of its 13F portfolio. MD Sass is also relatively very bullish on the stock, dishing out 3.98 percent of its 13F equity portfolio to DGX.

Since Quest Diagnostics Incorporated (NYSE:DGX) has experienced falling interest from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of funds that elected to cut their positions entirely last quarter. At the top of the heap, James Dinan’s York Capital Management said goodbye to the largest position of the “upper crust” of funds monitored by Insider Monkey, valued at an estimated $12.7 million in stock. John A. Levin’s fund, Levin Capital Strategies, also said goodbye to its stock, about $3.7 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 5 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to Quest Diagnostics Incorporated (NYSE:DGX). These stocks are MarketAxess Holdings Inc. (NASDAQ:MKTX), Liberty Global plc (NASDAQ:LBTYA), Magellan Midstream Partners, L.P. (NYSE:MMP), and CarMax Inc (NYSE:KMX). This group of stocks’ market valuations resemble DGX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MKTX | 27 | 636917 | 1 |

| LBTYA | 27 | 1199061 | -3 |

| MMP | 16 | 79559 | 1 |

| KMX | 50 | 1871871 | 6 |

| Average | 30 | 946852 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $947 million. That figure was $433 million in DGX’s case. CarMax Inc (NYSE:KMX) is the most popular stock in this table. On the other hand Magellan Midstream Partners, L.P. (NYSE:MMP) is the least popular one with only 16 bullish hedge fund positions. Quest Diagnostics Incorporated (NYSE:DGX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 22.3% in 2020 through March 16th but still beat the market by 3.2 percentage points. Hedge funds were also right about betting on DGX as the stock returned -18.7% during the first quarter (through March 16th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.