We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the government. The 13F filings show the funds’ and investors’ portfolio positions as of June 30. In this article we look at what those investors think of NXP Semiconductors NV (NASDAQ:NXPI) and compare it against similarly valued stocks like China Telecom Corporation Limited (ADR) (NYSE:CHA), National Grid plc (ADR) (NYSE:NGG), Regeneron Pharmaceuticals Inc (NASDAQ:REGN), and Fiat Chrysler Automobiles NV (NYSE:FCAU).

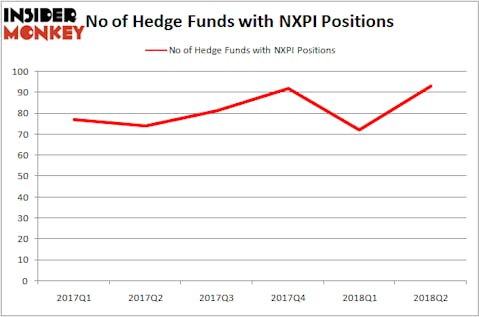

Hedge funds were overwhelmingly bullish on NXP Semiconductors NV (NASDAQ:NXPI) in second quarter even though Qualcomm’s acquisition of NXP Semiconductors failed before the end of the second quarter. Hedge funds know that Chinese regulators didn’t approve the deal by its deadline of June 25th, yet the number of bullish hedge fund bets moved up by 21 in Q2. NXPI became the 11th most popular stock among hedge funds at the end of the second quarter (see the list of 25 most popular stocks among hedge funds).

In the financial world there are a lot of formulas shareholders can use to analyze publicly traded companies. A duo of the best formulas are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the elite money managers can trounce their index-focused peers by a superb margin. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to review the fresh hedge fund action encompassing NXP Semiconductors NV (NASDAQ:NXPI).

What have hedge funds been doing with NXP Semiconductors NV (NASDAQ:NXPI)?

At the end of the third quarter, a total of 93 of the hedge funds tracked by Insider Monkey were long this stock, a change of 29% from the second quarter of 2018. On the other hand, there were a total of 74 hedge funds with a bullish position in NXPI at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Elliott Management held the most valuable stake in NXP Semiconductors NV (NASDAQ:NXPI), which was worth $1.9 billions at the end of the second quarter. Paul Singer’s hedge fund revealed reducing its NXPI position by about 40% by the end of July after Qualcomm called of the $44 billion deal to buy NXPI. On the second spot was HBK Investments which amassed $1.7 billions worth of shares. Moreover, Twin Capital Management, Litespeed Management, and Sand Grove Capital Partners were also bullish on NXP Semiconductors NV (NASDAQ:NXPI), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Litespeed Management, managed by Jamie Zimmerman, established the largest call position in NXP Semiconductors NV (NASDAQ:NXPI). Litespeed Management had $21.9 million invested in the company at the end of the quarter. Josh Resnick’s Jericho Capital Asset Management also initiated a $410.9 million position during the quarter. The following funds were also among the new NXPI investors: Curtis Macnguyen’s Ivory Capital, Keith Meister’s Corvex Capital, and Miguel Fidalgo’s Triarii Capital.

Let’s now take a look at hedge fund activity in other stocks similar to NXP Semiconductors NV (NASDAQ:NXPI). We will take a look at China Telecom Corporation Limited (ADR) (NYSE:CHA), National Grid plc (ADR) (NYSE:NGG), Regeneron Pharmaceuticals Inc (NASDAQ:REGN), and Fiat Chrysler Automobiles NV (NYSE:FCAU). This group of stocks’ market valuations are similar to NXPI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHA | 5 | 12840 | -4 |

| NGG | 13 | 275154 | 4 |

| REGN | 28 | 1074687 | 1 |

| FCAU | 29 | 1639946 | -2 |

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $751 million. That figure was $15.7 billion in NXPI’s case. Fiat Chrysler Automobiles NV (NYSE:FCAU) is the most popular stock in this table. On the other hand China Telecom Corporation Limited (ADR) (NYSE:CHA) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks NXP Semiconductors NV (NASDAQ:NXPI) is more popular among hedge funds.

There is a 45-day delay in 13F filings. Usually this delay doesn’t affect our stock picks noticeably. NXPI was an exception because hedge funds overwhelmingly bet on the stock even though it was becoming clear that Chinese regulators wasn’t going to approve the merger. I think hedge funds got burned because of the rumors in early June that China was ready to approve the deal and analysts were publishing bullish reports giving the impression that NXPI would perform well even if the deal doesn’t go through. Well, they were wrong. NXPI shares are currently trading at $82 and actually present a much better investment opportunity after receiving $2 billion in break-up fee from Qualcomm. We believe merger arbitrage focused hedge funds are done selling and NXPI will outperform the market in the next 12 months.

Disclosure: None. This article was originally published at Insider Monkey.