Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4.5 years and analyze what the smart money thinks of Bel Fuse, Inc. (NASDAQ:BELFA) based on that data.

Hedge fund interest in Bel Fuse, Inc. (NASDAQ:BELFA) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as RCI Hospitality Holdings, Inc. (NASDAQ:RICK), Alaska Communications Systems Group Inc (NASDAQ:ALSK), and Zagg Inc (NASDAQ:ZAGG) to gather more data points. Our calculations also showed that BELFA isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

According to most market participants, hedge funds are assumed to be worthless, old investment vehicles of the past. While there are more than 8000 funds trading at the moment, Our experts choose to focus on the crème de la crème of this group, approximately 850 funds. These hedge fund managers manage most of the smart money’s total capital, and by tracking their best picks, Insider Monkey has brought to light numerous investment strategies that have historically beaten the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Howard Marks of Oaktree Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020’s unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out stocks recommended/scorned by legendary Bill Miller. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s take a look at the new hedge fund action surrounding Bel Fuse, Inc. (NASDAQ:BELFA).

What have hedge funds been doing with Bel Fuse, Inc. (NASDAQ:BELFA)?

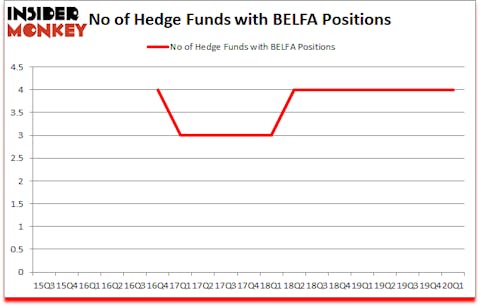

At the end of the first quarter, a total of 4 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the fourth quarter of 2019. Below, you can check out the change in hedge fund sentiment towards BELFA over the last 18 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, GAMCO Investors, managed by Mario Gabelli, holds the number one position in Bel Fuse, Inc. (NASDAQ:BELFA). GAMCO Investors has a $1.8 million position in the stock, comprising less than 0.1%% of its 13F portfolio. On GAMCO Investors’s heels is Oaktree Capital Management, managed by Howard Marks, which holds a $0.5 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors with similar optimism comprise Chuck Royce’s Royce & Associates, Renaissance Technologies and . In terms of the portfolio weights assigned to each position GAMCO Investors allocated the biggest weight to Bel Fuse, Inc. (NASDAQ:BELFA), around 0.02% of its 13F portfolio. Oaktree Capital Management is also relatively very bullish on the stock, dishing out 0.02 percent of its 13F equity portfolio to BELFA.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Bel Fuse, Inc. (NASDAQ:BELFA) but similarly valued. These stocks are RCI Hospitality Holdings, Inc. (NASDAQ:RICK), Alaska Communications Systems Group Inc (NASDAQ:ALSK), Zagg Inc (NASDAQ:ZAGG), and Twin Disc, Incorporated (NASDAQ:TWIN). All of these stocks’ market caps are similar to BELFA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RICK | 10 | 7475 | 1 |

| ALSK | 8 | 5978 | 3 |

| ZAGG | 8 | 19992 | -1 |

| TWIN | 5 | 17069 | -2 |

| Average | 7.75 | 12629 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.75 hedge funds with bullish positions and the average amount invested in these stocks was $13 million. That figure was $3 million in BELFA’s case. RCI Hospitality Holdings, Inc. (NASDAQ:RICK) is the most popular stock in this table. On the other hand Twin Disc, Incorporated (NASDAQ:TWIN) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Bel Fuse, Inc. (NASDAQ:BELFA) is even less popular than TWIN. Hedge funds clearly dropped the ball on BELFA as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May and still beat the market by 13.2 percentage points. A small number of hedge funds were also right about betting on BELFA as the stock returned 49.6% so far in the second quarter and outperformed the market by an even larger margin.

Follow Bel Fuse Inc (NASDAQ:BELFB)

Follow Bel Fuse Inc (NASDAQ:BELFB)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.