At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Essent Group Ltd (NYSE:ESNT).

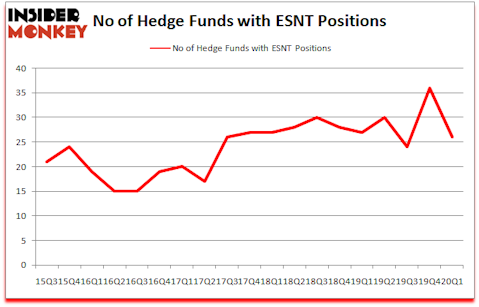

Essent Group Ltd (NYSE:ESNT) was in 26 hedge funds’ portfolios at the end of March. ESNT shareholders have witnessed a decrease in enthusiasm from smart money in recent months. There were 36 hedge funds in our database with ESNT holdings at the end of the previous quarter. Our calculations also showed that ESNT isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 58 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Noam Gottesman of GLG Partners

We leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we are checking out investment opportunities like these. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s take a glance at the recent hedge fund action encompassing Essent Group Ltd (NYSE:ESNT).

How are hedge funds trading Essent Group Ltd (NYSE:ESNT)?

Heading into the second quarter of 2020, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -28% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ESNT over the last 18 quarters. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

The largest stake in Essent Group Ltd (NYSE:ESNT) was held by Polar Capital, which reported holding $60.6 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $27.2 million position. Other investors bullish on the company included GLG Partners, Rima Senvest Management, and Millennium Management. In terms of the portfolio weights assigned to each position Beach Point Capital Management allocated the biggest weight to Essent Group Ltd (NYSE:ESNT), around 3.19% of its 13F portfolio. One Fin Capital Management is also relatively very bullish on the stock, setting aside 2.79 percent of its 13F equity portfolio to ESNT.

Due to the fact that Essent Group Ltd (NYSE:ESNT) has witnessed bearish sentiment from hedge fund managers, it’s safe to say that there is a sect of hedgies who sold off their positions entirely in the first quarter. It’s worth mentioning that Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital sold off the largest investment of the “upper crust” of funds monitored by Insider Monkey, worth an estimated $24.3 million in stock, and Shawn Bergerson and Martin Kalish’s Waterstone Capital Management was right behind this move, as the fund dropped about $2.3 million worth. These bearish behaviors are interesting, as total hedge fund interest dropped by 10 funds in the first quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Essent Group Ltd (NYSE:ESNT). We will take a look at TriNet Group Inc (NYSE:TNET), II-VI, Inc. (NASDAQ:IIVI), Cushman & Wakefield plc (NYSE:CWK), and Coherent, Inc. (NASDAQ:COHR). This group of stocks’ market valuations are closest to ESNT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TNET | 19 | 230192 | -1 |

| IIVI | 20 | 99773 | 2 |

| CWK | 15 | 89918 | -3 |

| COHR | 23 | 172545 | -5 |

| Average | 19.25 | 148107 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $148 million. That figure was $196 million in ESNT’s case. Coherent, Inc. (NASDAQ:COHR) is the most popular stock in this table. On the other hand Cushman & Wakefield plc (NYSE:CWK) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Essent Group Ltd (NYSE:ESNT) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 8.3% in 2020 through the end of May but still managed to beat the market by 13.2 percentage points. Hedge funds were also right about betting on ESNT as the stock returned 25.5% so far in Q2 (through the end of May) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Essent Group Ltd. (NYSE:ESNT)

Follow Essent Group Ltd. (NYSE:ESNT)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.