Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of June. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Assured Guaranty Ltd. (NYSE:AGO), so let’s take a closer look at the sentiment that surrounds AGO as well as similarly valued stocks like hina Biologic Products Holdings, Inc. (NASDAQ:CBPO), Pinnacle Financial Partners, Inc. (NASDAQ:PNFP), Companhia Siderurgica Nacional (NYSE:SID), and Littelfuse, Inc. (NASDAQ:LFUS) in the current quarter.

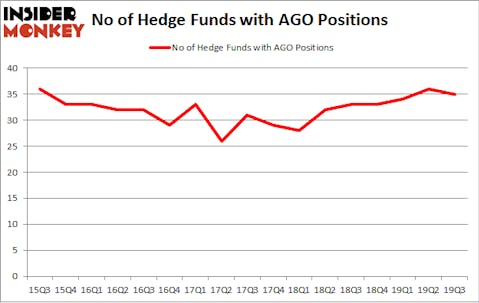

Is Assured Guaranty Ltd. (NYSE:AGO) a healthy stock for your portfolio? The best stock pickers are taking a pessimistic view. The number of bullish hedge fund bets were cut by 1 lately. Our calculations also showed that AGO isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). AGO was in 35 hedge funds’ portfolios at the end of the third quarter of 2019. There were 36 hedge funds in our database with AGO holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most traders, hedge funds are viewed as unimportant, old investment tools of years past. While there are over 8000 funds in operation at present, Our experts look at the masters of this club, around 750 funds. These money managers have their hands on most of the hedge fund industry’s total capital, and by paying attention to their inimitable investments, Insider Monkey has come up with a number of investment strategies that have historically surpassed the market. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points per year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Noam Gottesman of GLG Partners

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a peek at the recent hedge fund action regarding Assured Guaranty Ltd. (NYSE:AGO).

What does smart money think about Assured Guaranty Ltd. (NYSE:AGO)?

Heading into the fourth quarter of 2019, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of -3% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in AGO over the last 17 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, AQR Capital Management was the largest shareholder of Assured Guaranty Ltd. (NYSE:AGO), with a stake worth $176.4 million reported as of the end of September. Trailing AQR Capital Management was GLG Partners, which amassed a stake valued at $78.4 million. Kahn Brothers, Taconic Capital, and Arrowstreet Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Aurelius Capital Management allocated the biggest weight to Assured Guaranty Ltd. (NYSE:AGO), around 86.39% of its portfolio. Tegean Capital Management is also relatively very bullish on the stock, earmarking 15.86 percent of its 13F equity portfolio to AGO.

Due to the fact that Assured Guaranty Ltd. (NYSE:AGO) has faced a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there were a few funds that decided to sell off their full holdings in the third quarter. Intriguingly, Steven Tananbaum’s GoldenTree Asset Management dumped the largest stake of the “upper crust” of funds followed by Insider Monkey, totaling an estimated $13.4 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also said goodbye to its stock, about $12.5 million worth. These transactions are intriguing to say the least, as total hedge fund interest fell by 1 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Assured Guaranty Ltd. (NYSE:AGO) but similarly valued. These stocks are China Biologic Products Holdings, Inc. (NASDAQ:CBPO), Pinnacle Financial Partners, Inc. (NASDAQ:PNFP), Companhia Siderurgica Nacional (NYSE:SID), and Littelfuse, Inc. (NASDAQ:LFUS). This group of stocks’ market valuations resemble AGO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CBPO | 14 | 504724 | 5 |

| PNFP | 15 | 84557 | -3 |

| SID | 7 | 18261 | -3 |

| LFUS | 18 | 270623 | 3 |

| Average | 13.5 | 219541 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $220 million. That figure was $576 million in AGO’s case. Littelfuse, Inc. (NASDAQ:LFUS) is the most popular stock in this table. On the other hand Companhia Siderurgica Nacional (NYSE:SID) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Assured Guaranty Ltd. (NYSE:AGO) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on AGO as the stock returned 12.1% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.