World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

Is Assured Guaranty Ltd. (NYSE:AGO) undervalued? Prominent investors are taking a bullish view. The number of long hedge fund positions increased by 2 recently. Our calculations also showed that AGO isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most market participants, hedge funds are perceived as worthless, old investment tools of the past. While there are more than 8000 funds in operation at the moment, We look at the crème de la crème of this group, around 750 funds. These investment experts manage the lion’s share of the smart money’s total capital, and by keeping an eye on their first-class investments, Insider Monkey has found various investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the latest hedge fund action regarding Assured Guaranty Ltd. (NYSE:AGO).

Hedge fund activity in Assured Guaranty Ltd. (NYSE:AGO)

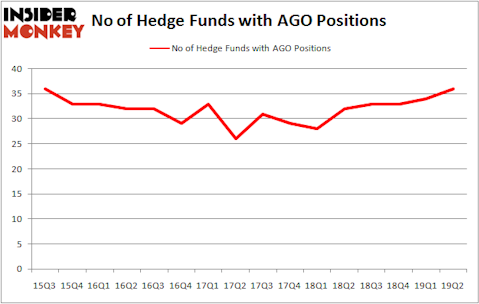

Heading into the third quarter of 2019, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards AGO over the last 16 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, AQR Capital Management held the most valuable stake in Assured Guaranty Ltd. (NYSE:AGO), which was worth $158.2 million at the end of the second quarter. On the second spot was GLG Partners which amassed $85.8 million worth of shares. Moreover, Kahn Brothers, Arrowstreet Capital, and Taconic Capital were also bullish on Assured Guaranty Ltd. (NYSE:AGO), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Kahn Brothers, managed by Irving Kahn, established the largest position in Assured Guaranty Ltd. (NYSE:AGO). Kahn Brothers had $65.9 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $0.8 million position during the quarter. The other funds with brand new AGO positions are Michael Gelband’s ExodusPoint Capital, Alec Litowitz and Ross Laser’s Magnetar Capital, and Claes Fornell’s CSat Investment Advisory.

Let’s now take a look at hedge fund activity in other stocks similar to Assured Guaranty Ltd. (NYSE:AGO). These stocks are Marriott Vacations Worldwide Corporation (NYSE:VAC), Sterling Bancorp (NYSE:STL), nVent Electric plc (NYSE:NVT), and Ternium S.A. (NYSE:TX). This group of stocks’ market values match AGO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VAC | 27 | 442811 | 1 |

| STL | 21 | 472824 | 2 |

| NVT | 28 | 776298 | 3 |

| TX | 14 | 74250 | 2 |

| Average | 22.5 | 441546 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $442 million. That figure was $614 million in AGO’s case. nVent Electric plc (NYSE:NVT) is the most popular stock in this table. On the other hand Ternium S.A. (NYSE:TX) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Assured Guaranty Ltd. (NYSE:AGO) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on AGO as the stock returned 6.1% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.