In this article we will check out the progression of hedge fund sentiment towards Zoom Video Communications, Inc. (NASDAQ:ZM) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

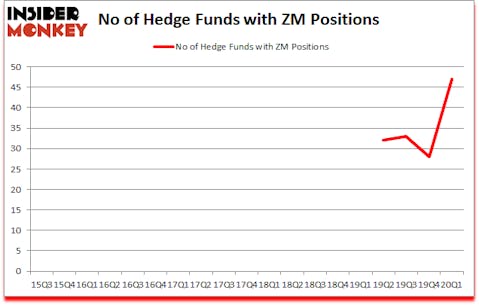

Zoom Video Communications, Inc. (NASDAQ:ZM) investors should be aware of an increase in enthusiasm from smart money in recent months. ZM was in 47 hedge funds’ portfolios at the end of the first quarter of 2020. There were 28 hedge funds in our database with ZM positions at the end of the previous quarter. Our calculations also showed that ZM isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most traders, hedge funds are seen as worthless, outdated financial vehicles of yesteryear. While there are more than 8000 funds trading today, Our experts look at the elite of this club, around 850 funds. Most estimates calculate that this group of people preside over the lion’s share of the hedge fund industry’s total asset base, and by monitoring their best picks, Insider Monkey has unsheathed a few investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we are still not out of the woods in terms of the coronavirus pandemic. So, we checked out this successful trader’s “corona catalyst plays“. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s take a look at the new hedge fund action encompassing Zoom Video Communications, Inc. (NASDAQ:ZM).

How have hedgies been trading Zoom Video Communications, Inc. (NASDAQ:ZM)?

At the end of the first quarter, a total of 47 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 68% from the fourth quarter of 2019. On the other hand, there were a total of 0 hedge funds with a bullish position in ZM a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Zoom Video Communications, Inc. (NASDAQ:ZM) was held by Hillhouse Capital Management, which reported holding $905.1 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $405.9 million position. Other investors bullish on the company included Whale Rock Capital Management, Tiger Global Management LLC, and Citadel Investment Group. In terms of the portfolio weights assigned to each position Wildcat Capital Management allocated the biggest weight to Zoom Video Communications, Inc. (NASDAQ:ZM), around 14.26% of its 13F portfolio. Strategy Capital is also relatively very bullish on the stock, dishing out 13.09 percent of its 13F equity portfolio to ZM.

As one would reasonably expect, key money managers have jumped into Zoom Video Communications, Inc. (NASDAQ:ZM) headfirst. Renaissance Technologies, assembled the most outsized position in Zoom Video Communications, Inc. (NASDAQ:ZM). Renaissance Technologies had $405.9 million invested in the company at the end of the quarter. Alex Sacerdote’s Whale Rock Capital Management also made a $301.2 million investment in the stock during the quarter. The other funds with brand new ZM positions are Philippe Laffont’s Coatue Management, Rajiv Jain’s GQG Partners, and D. E. Shaw’s D E Shaw.

Let’s now review hedge fund activity in other stocks similar to Zoom Video Communications, Inc. (NASDAQ:ZM). We will take a look at Walgreens Boots Alliance Inc (NASDAQ:WBA), Equinor ASA (NYSE:EQNR), Illumina, Inc. (NASDAQ:ILMN), and Moody’s Corporation (NYSE:MCO). This group of stocks’ market values match ZM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WBA | 45 | 461497 | 7 |

| EQNR | 11 | 281375 | -3 |

| ILMN | 34 | 1130705 | -9 |

| MCO | 50 | 8552785 | 1 |

| Average | 35 | 2606591 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35 hedge funds with bullish positions and the average amount invested in these stocks was $2607 million. That figure was $2384 million in ZM’s case. Moody’s Corporation (NYSE:MCO) is the most popular stock in this table. On the other hand Equinor ASA (NYSE:EQNR) is the least popular one with only 11 bullish hedge fund positions. Zoom Video Communications, Inc. (NASDAQ:ZM) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 7.9% in 2020 through May 22nd but still beat the market by 15.6 percentage points. Hedge funds were also right about betting on ZM, though not to the same extent, as the stock returned 17.1% during the first two months of the second quarter (through May 22nd) and outperformed the market as well.

Follow Zoom Communications Inc. (NASDAQ:ZM)

Follow Zoom Communications Inc. (NASDAQ:ZM)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.