A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended March 31, so let’s proceed with the discussion of the hedge fund sentiment on Workiva Inc (NYSE:WK).

Workiva Inc (NYSE:WK) has experienced an increase in hedge fund interest of late. Our calculations also showed that WK isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a peek at the fresh hedge fund action encompassing Workiva Inc (NYSE:WK).

What have hedge funds been doing with Workiva Inc (NYSE:WK)?

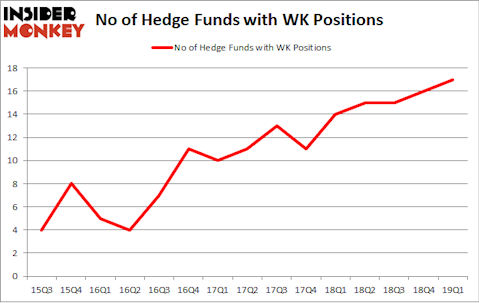

At the end of the first quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in WK over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Workiva Inc (NYSE:WK) was held by Renaissance Technologies, which reported holding $82.9 million worth of stock at the end of March. It was followed by Millennium Management with a $30.8 million position. Other investors bullish on the company included Hawk Ridge Management, Citadel Investment Group, and Arrowstreet Capital.

As industrywide interest jumped, key money managers have jumped into Workiva Inc (NYSE:WK) headfirst. HBK Investments, managed by David Costen Haley, created the largest position in Workiva Inc (NYSE:WK). HBK Investments had $2.4 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $1 million position during the quarter. The other funds with brand new WK positions are Dmitry Balyasny’s Balyasny Asset Management, Bruce Kovner’s Caxton Associates LP, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Workiva Inc (NYSE:WK). These stocks are Hamilton Lane Incorporated (NASDAQ:HLNE), Independent Bank Group Inc (NASDAQ:IBTX), Uniqure NV (NASDAQ:QURE), and Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. (NASDAQ:OMAB). This group of stocks’ market values are closest to WK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HLNE | 10 | 54571 | 1 |

| IBTX | 10 | 127668 | -3 |

| QURE | 28 | 529925 | 11 |

| OMAB | 6 | 55473 | 1 |

| Average | 13.5 | 191909 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $192 million. That figure was $235 million in WK’s case. Uniqure NV (NASDAQ:QURE) is the most popular stock in this table. On the other hand Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. (NASDAQ:OMAB) is the least popular one with only 6 bullish hedge fund positions. Workiva Inc (NYSE:WK) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on WK as the stock returned 12.5% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.