There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Jeff Ubben, George Soros and Carl Icahn think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Workiva Inc (NYSE:WK).

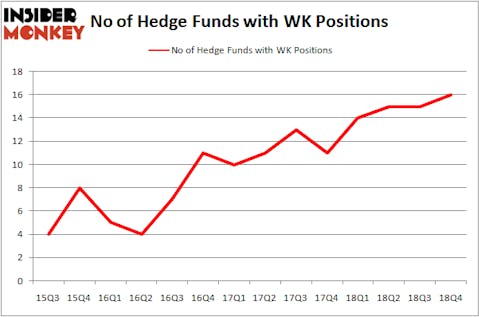

Workiva Inc (NYSE:WK) investors should pay attention to an increase in hedge fund sentiment of late. Our calculations also showed that WK isn’t among the 30 most popular stocks among hedge funds.

Today there are dozens of formulas investors put to use to analyze stocks. A duo of the most underrated formulas are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the top money managers can trounce the market by a significant margin (see the details here).

We’re going to view the latest hedge fund action regarding Workiva Inc (NYSE:WK).

How are hedge funds trading Workiva Inc (NYSE:WK)?

At Q4’s end, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 7% from the previous quarter. By comparison, 14 hedge funds held shares or bullish call options in WK a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

The largest stake in Workiva Inc (NYSE:WK) was held by Renaissance Technologies, which reported holding $48 million worth of stock at the end of December. It was followed by Citadel Investment Group with a $20.9 million position. Other investors bullish on the company included Hawk Ridge Management, Millennium Management, and Foxhaven Asset Management.

As aggregate interest increased, specific money managers have jumped into Workiva Inc (NYSE:WK) headfirst. StackLine Partners, managed by Brian Gootzeit and Andrew Frank, created the most outsized position in Workiva Inc (NYSE:WK). StackLine Partners had $4.4 million invested in the company at the end of the quarter.

Let’s check out hedge fund activity in other stocks similar to Workiva Inc (NYSE:WK). These stocks are Moelis & Company (NYSE:MC), FCB Financial Holdings Inc (NYSE:FCB), Amkor Technology, Inc. (NASDAQ:AMKR), and Kaman Corporation (NYSE:KAMN). This group of stocks’ market valuations are similar to WK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MC | 21 | 72307 | 1 |

| FCB | 18 | 269486 | -5 |

| AMKR | 24 | 51025 | 6 |

| KAMN | 12 | 257876 | -8 |

| Average | 18.75 | 162674 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $163 million. That figure was $148 million in WK’s case. Amkor Technology, Inc. (NASDAQ:AMKR) is the most popular stock in this table. On the other hand Kaman Corporation (NYSE:KAMN) is the least popular one with only 12 bullish hedge fund positions. Workiva Inc (NYSE:WK) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on WK as the stock returned 39.1% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.