Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4.5 years and analyze what the smart money thinks of Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) based on that data.

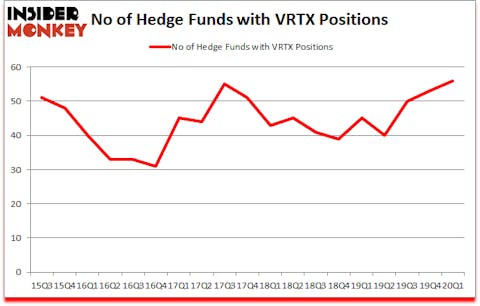

Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) was in 56 hedge funds’ portfolios at the end of the first quarter of 2020. VRTX shareholders have witnessed an increase in hedge fund interest lately. There were 53 hedge funds in our database with VRTX positions at the end of the previous quarter. Our calculations also showed that VRTX isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are numerous signals stock traders can use to assess publicly traded companies. Two of the less known signals are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the best hedge fund managers can outclass the broader indices by a very impressive margin (see the details here).

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we are still not out of the woods in terms of the coronavirus pandemic. So, we checked out this analyst’s “corona catalyst plays“. We interview hedge fund managers and ask them about best ideas. You can watch our latest hedge fund manager interview here and find out the name of the large-cap healthcare stock that Sio Capital’s Michael Castor expects to double. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to review the recent hedge fund action regarding Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX).

Hedge fund activity in Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX)

At the end of the first quarter, a total of 56 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards VRTX over the last 18 quarters. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX), with a stake worth $1632.3 million reported as of the end of September. Trailing Renaissance Technologies was Two Sigma Advisors, which amassed a stake valued at $262.2 million. Adage Capital Management, OrbiMed Advisors, and GQG Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Copernicus Capital Management allocated the biggest weight to Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX), around 15.1% of its 13F portfolio. Parkman Healthcare Partners is also relatively very bullish on the stock, designating 4.72 percent of its 13F equity portfolio to VRTX.

Now, some big names were breaking ground themselves. Rhenman & Partners Asset Management, managed by Henrik Rhenman, initiated the biggest position in Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX). Rhenman & Partners Asset Management had $27.4 million invested in the company at the end of the quarter. Ken Heebner’s Capital Growth Management also initiated a $20.2 million position during the quarter. The other funds with brand new VRTX positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Arsani William’s Logos Capital, and Minhua Zhang’s Weld Capital Management.

Let’s check out hedge fund activity in other stocks similar to Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX). These stocks are Dominion Energy Inc. (NYSE:D), Crown Castle International Corp. (NYSE:CCI), Intuit Inc. (NASDAQ:INTU), and S&P Global Inc. (NYSE:SPGI). This group of stocks’ market values resemble VRTX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| D | 34 | 371177 | -3 |

| CCI | 40 | 1640829 | 2 |

| INTU | 54 | 1557455 | 0 |

| SPGI | 73 | 2586131 | -3 |

| Average | 50.25 | 1538898 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 50.25 hedge funds with bullish positions and the average amount invested in these stocks was $1539 million. That figure was $3314 million in VRTX’s case. S&P Global Inc. (NYSE:SPGI) is the most popular stock in this table. On the other hand Dominion Energy Inc. (NYSE:D) is the least popular one with only 34 bullish hedge fund positions. Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 7.9% in 2020 through May 22nd but still beat the market by 15.6 percentage points. Hedge funds were also right about betting on VRTX, though not to the same extent, as the stock returned 19.8% during the first two months of the second quarter (through May 22nd) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.