Is SRC Energy Inc. (NYSE:SRCI) a good bet right now? We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

SRC Energy Inc. (NYSE:SRCI) has experienced an increase in activity from the world’s largest hedge funds recently. Our calculations also showed that SRCI isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are a lot of signals investors put to use to evaluate their holdings. Some of the less utilized signals are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the elite money managers can beat the S&P 500 by a significant margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s go over the recent hedge fund action encompassing SRC Energy Inc. (NYSE:SRCI).

What does smart money think about SRC Energy Inc. (NYSE:SRCI)?

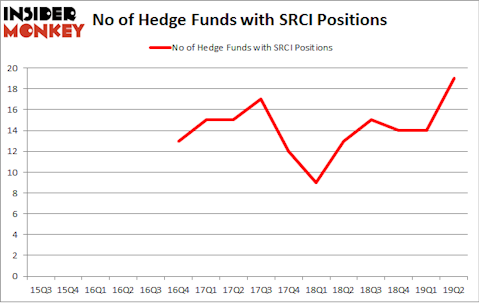

Heading into the third quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 36% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards SRCI over the last 16 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, SailingStone Capital Partners held the most valuable stake in SRC Energy Inc. (NYSE:SRCI), which was worth $90.8 million at the end of the second quarter. On the second spot was Millennium Management which amassed $40.6 million worth of shares. Moreover, Deep Basin Capital, Fine Capital Partners, and D E Shaw were also bullish on SRC Energy Inc. (NYSE:SRCI), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. Alyeska Investment Group, managed by Anand Parekh, created the most valuable position in SRC Energy Inc. (NYSE:SRCI). Alyeska Investment Group had $15.8 million invested in the company at the end of the quarter. Vince Maddi and Shawn Brennan’s SIR Capital Management also made a $5.6 million investment in the stock during the quarter. The other funds with brand new SRCI positions are Jonathan Barrett and Paul Segal’s Luminus Management, Clint Carlson’s Carlson Capital, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now review hedge fund activity in other stocks similar to SRC Energy Inc. (NYSE:SRCI). These stocks are Scholastic Corporation (NASDAQ:SCHL), Axonics Modulation Technologies, Inc. (NASDAQ:AXNX), KKR Real Estate Finance Trust Inc. (NYSE:KREF), and Arbor Realty Trust, Inc. (NYSE:ABR). This group of stocks’ market values match SRCI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SCHL | 14 | 71291 | 4 |

| AXNX | 12 | 132890 | 2 |

| KREF | 9 | 50623 | 0 |

| ABR | 14 | 101201 | 5 |

| Average | 12.25 | 89001 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $89 million. That figure was $305 million in SRCI’s case. Scholastic Corporation (NASDAQ:SCHL) is the most popular stock in this table. On the other hand KKR Real Estate Finance Trust Inc. (NYSE:KREF) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks SRC Energy Inc. (NYSE:SRCI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately SRCI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SRCI were disappointed as the stock returned -6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.