It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 24.4% during the first 9 months of 2019 and outperformed the S&P 500 ETF by 4 percentage points. We are done processing the latest 13f filings and in this article we will study how hedge fund sentiment towards SpartanNash Company (NASDAQ:SPTN) changed during the first quarter.

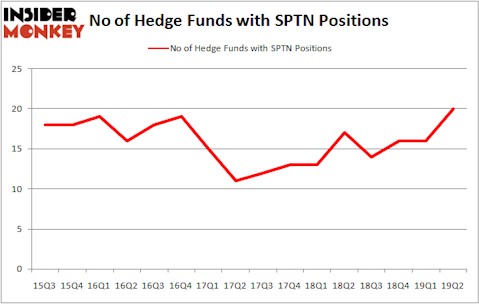

SpartanNash Company (NASDAQ:SPTN) has seen an increase in hedge fund sentiment recently. Our calculations also showed that SPTN isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most market participants, hedge funds are perceived as underperforming, outdated financial tools of yesteryear. While there are over 8000 funds in operation today, Our researchers look at the top tier of this club, around 750 funds. These investment experts shepherd bulk of all hedge funds’ total asset base, and by tracking their unrivaled picks, Insider Monkey has revealed numerous investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike other investors who track every movement of the 25 largest hedge funds, our long-short investment strategy relies on hedge fund buy/sell signals given by the 100 best performing hedge funds. Let’s view the recent hedge fund action surrounding SpartanNash Company (NASDAQ:SPTN).

How have hedgies been trading SpartanNash Company (NASDAQ:SPTN)?

At the end of the second quarter, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from the previous quarter. By comparison, 17 hedge funds held shares or bullish call options in SPTN a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Among these funds, AQR Capital Management held the most valuable stake in SpartanNash Company (NASDAQ:SPTN), which was worth $5.9 million at the end of the second quarter. On the second spot was Renaissance Technologies which amassed $4.8 million worth of shares. Moreover, Private Capital Management, Citadel Investment Group, and Millennium Management were also bullish on SpartanNash Company (NASDAQ:SPTN), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Weld Capital Management, managed by Minhua Zhang, created the largest position in SpartanNash Company (NASDAQ:SPTN). Weld Capital Management had $0.6 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $0.4 million position during the quarter. The following funds were also among the new SPTN investors: Benjamin A. Smith’s Laurion Capital Management, Paul Tudor Jones’s Tudor Investment Corp, and Bruce Kovner’s Caxton Associates LP.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as SpartanNash Company (NASDAQ:SPTN) but similarly valued. We will take a look at Bonanza Creek Energy Inc (NYSE:BCEI), VirnetX Holding Corporation (NYSE:VHC), Landmark Infrastructure Partners LP (NASDAQ:LMRK), and New Frontier Corp (NYSE:NFC). This group of stocks’ market caps match SPTN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BCEI | 15 | 147271 | -1 |

| VHC | 3 | 555 | 1 |

| LMRK | 4 | 2441 | -1 |

| NFC | 12 | 56016 | -1 |

| Average | 8.5 | 51571 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $52 million. That figure was $28 million in SPTN’s case. Bonanza Creek Energy Inc (NYSE:BCEI) is the most popular stock in this table. On the other hand VirnetX Holding Corporation (NYSE:VHC) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks SpartanNash Company (NASDAQ:SPTN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on SPTN, though not to the same extent, as the stock returned 3% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.