The Insider Monkey team has completed processing the quarterly 13F filings for the March quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards SpartanNash Company (NASDAQ:SPTN).

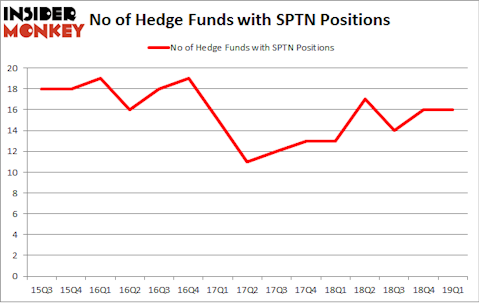

SpartanNash Company (NASDAQ:SPTN) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 16 hedge funds’ portfolios at the end of the first quarter of 2019. At the end of this article we will also compare SPTN to other stocks including Farmers & Merchants Bancorp (OTC:FMCB), Nexgen Energy Ltd. (NYSE:NXE), and BP Prudhoe Bay Royalty Trust (NYSE:BPT) to get a better sense of its popularity.

To the average investor there are plenty of tools stock traders put to use to appraise their holdings. A pair of the most under-the-radar tools are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the top money managers can outperform the broader indices by a superb amount (see the details here).

Cliff Asness of AQR Capital Management

We’re going to go over the fresh hedge fund action regarding SpartanNash Company (NASDAQ:SPTN).

What does smart money think about SpartanNash Company (NASDAQ:SPTN)?

At the end of the first quarter, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the fourth quarter of 2018. On the other hand, there were a total of 13 hedge funds with a bullish position in SPTN a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

The largest stake in SpartanNash Company (NASDAQ:SPTN) was held by Private Capital Management, which reported holding $18.9 million worth of stock at the end of March. It was followed by AQR Capital Management with a $5.9 million position. Other investors bullish on the company included Arrowstreet Capital, Millennium Management, and Renaissance Technologies.

Due to the fact that SpartanNash Company (NASDAQ:SPTN) has experienced falling interest from hedge fund managers, it’s safe to say that there lies a certain “tier” of funds that elected to cut their entire stakes by the end of the third quarter. Interestingly, Minhua Zhang’s Weld Capital Management dumped the biggest stake of all the hedgies tracked by Insider Monkey, worth about $0.2 million in stock. Paul Hondros’s fund, AlphaOne Capital Partners, also said goodbye to its stock, about $0 million worth. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to SpartanNash Company (NASDAQ:SPTN). These stocks are Farmers & Merchants Bancorp (OTC:FMCB), Nexgen Energy Ltd. (NYSE:NXE), BP Prudhoe Bay Royalty Trust (NYSE:BPT), and Customers Bancorp Inc (NYSE:CUBI). This group of stocks’ market valuations are similar to SPTN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FMCB | 2 | 755 | 1 |

| NXE | 8 | 26022 | 1 |

| BPT | 4 | 8606 | 0 |

| CUBI | 13 | 39780 | -2 |

| Average | 6.75 | 18791 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $19 million. That figure was $43 million in SPTN’s case. Customers Bancorp Inc (NYSE:CUBI) is the most popular stock in this table. On the other hand Farmers & Merchants Bancorp (OTC:FMCB) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks SpartanNash Company (NASDAQ:SPTN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately SPTN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SPTN were disappointed as the stock returned -28% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.