Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 26% in 2019 (through November 22nd). Conversely, hedge funds’ 20 preferred S&P 500 stocks generated a return of nearly 35% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ consensus stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Snap Inc. (NYSE:SNAP).

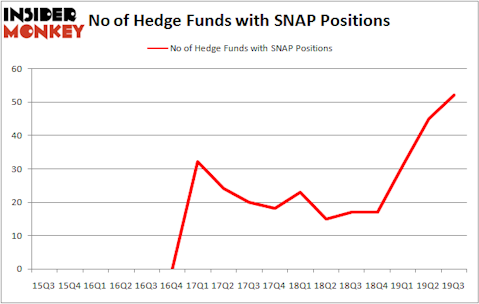

Snap Inc. (NYSE:SNAP) has experienced an increase in activity from the world’s largest hedge funds of late. SNAP was in 52 hedge funds’ portfolios at the end of the third quarter of 2019. There were 45 hedge funds in our database with SNAP positions at the end of the previous quarter. Our calculations also showed that SNAP isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Lei Zhang of Hillhouse Capital Management

Let’s review the key hedge fund action surrounding Snap Inc. (NYSE:SNAP).

Hedge fund activity in Snap Inc. (NYSE:SNAP)

Heading into the fourth quarter of 2019, a total of 52 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 16% from one quarter earlier. On the other hand, there were a total of 17 hedge funds with a bullish position in SNAP a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Jericho Capital Asset Management, managed by Josh Resnick, holds the most valuable position in Snap Inc. (NYSE:SNAP). Jericho Capital Asset Management has a $246.3 million position in the stock, comprising 14.1% of its 13F portfolio. On Jericho Capital Asset Management’s heels is Slate Path Capital, led by David Greenspan, holding a $228.2 million position; the fund has 15.1% of its 13F portfolio invested in the stock. Remaining members of the smart money that are bullish include Eashwar Krishnan’s Tybourne Capital Management, Ken Griffin’s Citadel Investment Group and David E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Slate Path Capital allocated the biggest weight to Snap Inc. (NYSE:SNAP), around 15.11% of its portfolio. Jericho Capital Asset Management is also relatively very bullish on the stock, setting aside 14.06 percent of its 13F equity portfolio to SNAP.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. Coatue Management, managed by Philippe Laffont, assembled the biggest position in Snap Inc. (NYSE:SNAP). Coatue Management had $166.1 million invested in the company at the end of the quarter. John Overdeck and David Siegel’s Two Sigma Advisors also initiated a $87.3 million position during the quarter. The other funds with new positions in the stock are Lei Zhang’s Hillhouse Capital Management, David Fiszel’s Honeycomb Asset Management, and Seth Wunder’s Black-and-White Capital.

Let’s now review hedge fund activity in other stocks similar to Snap Inc. (NYSE:SNAP). We will take a look at Cerner Corporation (NASDAQ:CERN), CoStar Group Inc (NASDAQ:CSGP), Essex Property Trust Inc (NYSE:ESS), and TELUS Corporation (NYSE:TU). This group of stocks’ market caps match SNAP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CERN | 33 | 954875 | 4 |

| CSGP | 35 | 1384331 | 3 |

| ESS | 18 | 400479 | -1 |

| TU | 17 | 301500 | 4 |

| Average | 25.75 | 760296 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $760 million. That figure was $2118 million in SNAP’s case. CoStar Group Inc (NASDAQ:CSGP) is the most popular stock in this table. On the other hand TELUS Corporation (NYSE:TU) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Snap Inc. (NYSE:SNAP) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately SNAP wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SNAP were disappointed as the stock returned -3.4% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.