Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter of 2018. Trends reversed 180 degrees during the first half of 2019 amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the second quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Simulations Plus, Inc. (NASDAQ:SLP).

Is Simulations Plus, Inc. (NASDAQ:SLP) a buy right now? Investors who are in the know are taking an optimistic view. The number of bullish hedge fund positions inched up by 3 in recent months. Our calculations also showed that SLP isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most shareholders, hedge funds are seen as slow, old financial vehicles of years past. While there are greater than 8000 funds in operation at the moment, We choose to focus on the moguls of this group, around 750 funds. These hedge fund managers shepherd most of the hedge fund industry’s total capital, and by keeping track of their highest performing picks, Insider Monkey has found a number of investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points a year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to go over the key hedge fund action regarding Simulations Plus, Inc. (NASDAQ:SLP).

How have hedgies been trading Simulations Plus, Inc. (NASDAQ:SLP)?

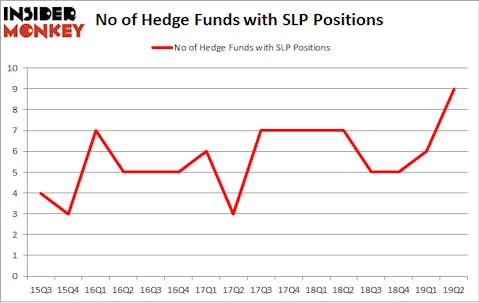

At the end of the second quarter, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 50% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in SLP over the last 16 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Renaissance Technologies has the number one position in Simulations Plus, Inc. (NASDAQ:SLP), worth close to $15.9 million, comprising less than 0.1%% of its total 13F portfolio. Sitting at the No. 2 spot is Chuck Royce of Royce & Associates, with a $8 million position; 0.1% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors that are bullish encompass Frederick DiSanto’s Ancora Advisors, Israel Englander’s Millennium Management and Matthew Hulsizer’s PEAK6 Capital Management.

Now, some big names were leading the bulls’ herd. Millennium Management, managed by Israel Englander, assembled the most valuable position in Simulations Plus, Inc. (NASDAQ:SLP). Millennium Management had $1.2 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $0.8 million position during the quarter. The other funds with new positions in the stock are Bruce Kovner’s Caxton Associates LP, Peter Algert and Kevin Coldiron’s Algert Coldiron Investors, and Thomas Bailard’s Bailard Inc.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Simulations Plus, Inc. (NASDAQ:SLP) but similarly valued. These stocks are Gores Metropoulos, Inc. (NASDAQ:GMHI), CytomX Therapeutics, Inc. (NASDAQ:CTMX), Whitestone REIT (NYSE:WSR), and CURO Group Holdings Corp. (NYSE:CURO). All of these stocks’ market caps resemble SLP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GMHI | 20 | 163482 | 2 |

| CTMX | 15 | 92893 | -3 |

| WSR | 4 | 16913 | -1 |

| CURO | 13 | 90202 | -4 |

| Average | 13 | 90873 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $91 million. That figure was $32 million in SLP’s case. Gores Metropoulos, Inc. (NASDAQ:GMHI) is the most popular stock in this table. On the other hand Whitestone REIT (NYSE:WSR) is the least popular one with only 4 bullish hedge fund positions. Simulations Plus, Inc. (NASDAQ:SLP) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on SLP as the stock returned 21.7% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.