We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 835 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article we look at what those investors think of Scientific Games Corp (NASDAQ:SGMS).

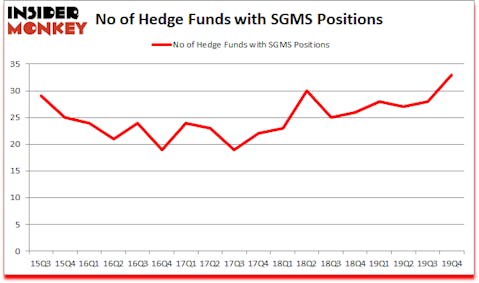

Scientific Games Corp (NASDAQ:SGMS) has seen an increase in support from the world’s most elite money managers in recent months. Our calculations also showed that SGMS isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

At the moment there are a large number of indicators stock traders use to size up publicly traded companies. Two of the less known indicators are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the best investment managers can trounce the S&P 500 by a significant amount (see the details here).

We leave no stone unturned when looking for the next great investment idea. For example we recently identified a stock that trades 25% below the net cash on its balance sheet. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to view the fresh hedge fund action surrounding Scientific Games Corp (NASDAQ:SGMS).

What have hedge funds been doing with Scientific Games Corp (NASDAQ:SGMS)?

At the end of the fourth quarter, a total of 33 of the hedge funds tracked by Insider Monkey were long this stock, a change of 18% from one quarter earlier. By comparison, 26 hedge funds held shares or bullish call options in SGMS a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Scientific Games Corp (NASDAQ:SGMS) was held by Fine Capital Partners, which reported holding $244 million worth of stock at the end of September. It was followed by Sylebra Capital Management with a $230.8 million position. Other investors bullish on the company included Nantahala Capital Management, Stone House Capital, and Nantahala Capital Management. In terms of the portfolio weights assigned to each position Stone House Capital allocated the biggest weight to Scientific Games Corp (NASDAQ:SGMS), around 91.11% of its 13F portfolio. Fine Capital Partners is also relatively very bullish on the stock, earmarking 64.5 percent of its 13F equity portfolio to SGMS.

Now, some big names were breaking ground themselves. PDT Partners, managed by Peter Muller, created the largest position in Scientific Games Corp (NASDAQ:SGMS). PDT Partners had $1.5 million invested in the company at the end of the quarter. Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital also made a $1.2 million investment in the stock during the quarter. The following funds were also among the new SGMS investors: David Harding’s Winton Capital Management, Peter Algert and Kevin Coldiron’s Algert Coldiron Investors, and Matthew Tewksbury’s Stevens Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Scientific Games Corp (NASDAQ:SGMS). These stocks are Avon Products, Inc. (NYSE:AVP), SeaWorld Entertainment Inc (NYSE:SEAS), Delek US Holdings, Inc. (NYSE:DK), and Domtar Corporation (NYSE:UFS). This group of stocks’ market caps match SGMS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVP | 13 | 307162 | -8 |

| SEAS | 39 | 1283543 | 4 |

| DK | 19 | 61378 | -3 |

| UFS | 26 | 147091 | 3 |

| Average | 24.25 | 449794 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $450 million. That figure was $726 million in SGMS’s case. SeaWorld Entertainment Inc (NYSE:SEAS) is the most popular stock in this table. On the other hand Avon Products, Inc. (NYSE:AVP) is the least popular one with only 13 bullish hedge fund positions. Scientific Games Corp (NASDAQ:SGMS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 17.4% in 2020 through March 25th but beat the market by 5.5 percentage points. Unfortunately SGMS wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SGMS were disappointed as the stock returned -61.2% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.