Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before the Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first quarter, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first quarter still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Scientific Games Corp (NASDAQ:SGMS) changed recently.

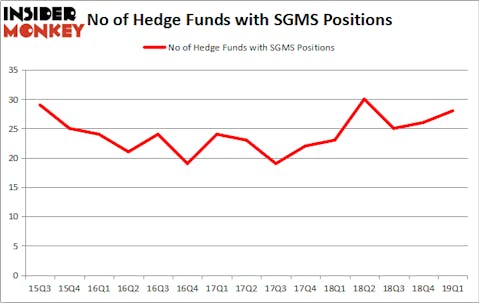

Is Scientific Games Corp (NASDAQ:SGMS) the right investment to pursue these days? Hedge funds are getting more optimistic. The number of bullish hedge fund bets advanced by 2 in recent months. Our calculations also showed that SGMS isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are seen as slow, old investment tools of yesteryear. While there are over 8000 funds with their doors open at the moment, We choose to focus on the top tier of this group, around 750 funds. These hedge fund managers handle bulk of all hedge funds’ total asset base, and by following their top equity investments, Insider Monkey has brought to light a number of investment strategies that have historically exceeded the market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to take a peek at the new hedge fund action regarding Scientific Games Corp (NASDAQ:SGMS).

How have hedgies been trading Scientific Games Corp (NASDAQ:SGMS)?

At the end of the first quarter, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of 8% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in SGMS over the last 15 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

Among these funds, Fine Capital Partners held the most valuable stake in Scientific Games Corp (NASDAQ:SGMS), which was worth $179.4 million at the end of the first quarter. On the second spot was Sylebra Capital Management which amassed $176 million worth of shares. Moreover, Nantahala Capital Management, Whale Rock Capital Management, and Jericho Capital Asset Management were also bullish on Scientific Games Corp (NASDAQ:SGMS), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Jericho Capital Asset Management, managed by Josh Resnick, created the largest position in Scientific Games Corp (NASDAQ:SGMS). Jericho Capital Asset Management had $42.2 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $10.5 million position during the quarter. The following funds were also among the new SGMS investors: Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Chuck Royce’s Royce & Associates, and Matthew Tewksbury’s Stevens Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Scientific Games Corp (NASDAQ:SGMS) but similarly valued. These stocks are Anixter International Inc. (NYSE:AXE), Seaspan Corporation (NYSE:SSW), Bloomin’ Brands Inc (NASDAQ:BLMN), and Trinseo S.A. (NYSE:TSE). This group of stocks’ market caps are closest to SGMS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AXE | 23 | 258461 | 9 |

| SSW | 9 | 683349 | -3 |

| BLMN | 24 | 299227 | 2 |

| TSE | 19 | 98278 | 3 |

| Average | 18.75 | 334829 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $335 million. That figure was $605 million in SGMS’s case. Bloomin’ Brands Inc (NASDAQ:BLMN) is the most popular stock in this table. On the other hand Seaspan Corporation (NYSE:SSW) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Scientific Games Corp (NASDAQ:SGMS) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately SGMS wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SGMS were disappointed as the stock returned -0.5% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.