Is Peapack-Gladstone Financial Corp (NASDAQ:PGC) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

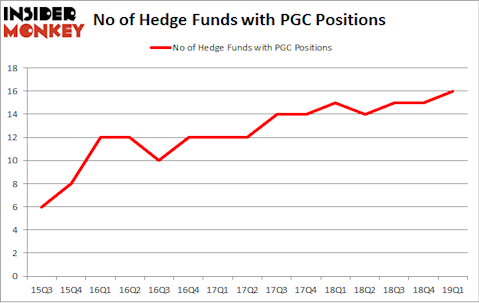

Peapack-Gladstone Financial Corp (NASDAQ:PGC) shareholders have witnessed an increase in activity from the world’s largest hedge funds of late. PGC was in 16 hedge funds’ portfolios at the end of March. There were 15 hedge funds in our database with PGC positions at the end of the previous quarter. Our calculations also showed that pgc isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the recent hedge fund action regarding Peapack-Gladstone Financial Corp (NASDAQ:PGC).

What have hedge funds been doing with Peapack-Gladstone Financial Corp (NASDAQ:PGC)?

At Q1’s end, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from the previous quarter. By comparison, 15 hedge funds held shares or bullish call options in PGC a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Matthew Lindenbaum’s Basswood Capital has the most valuable position in Peapack-Gladstone Financial Corp (NASDAQ:PGC), worth close to $18.5 million, accounting for 1.2% of its total 13F portfolio. On Basswood Capital’s heels is Endicott Management, led by Robert I. Usdan and Wayne K. Goldstein, holding a $13.1 million position; 12.8% of its 13F portfolio is allocated to the stock. Remaining peers that are bullish comprise Chuck Royce’s Royce & Associates, Jim Simons’s Renaissance Technologies and Anton Schutz’s Mendon Capital Advisors.

Now, some big names were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the most outsized position in Peapack-Gladstone Financial Corp (NASDAQ:PGC). Arrowstreet Capital had $1 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $0.3 million investment in the stock during the quarter. The only other fund with a new position in the stock is Mario Gabelli’s GAMCO Investors.

Let’s now take a look at hedge fund activity in other stocks similar to Peapack-Gladstone Financial Corp (NASDAQ:PGC). These stocks are El Pollo LoCo Holdings Inc (NASDAQ:LOCO), Triple-S Management Corp.(NYSE:GTS), REX American Resources Corp (NYSE:REX), and Ichor Holdings, Ltd. (NASDAQ:ICHR). This group of stocks’ market caps are similar to PGC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LOCO | 16 | 26986 | 0 |

| GTS | 12 | 76726 | 0 |

| REX | 6 | 41966 | -1 |

| ICHR | 10 | 54349 | 3 |

| Average | 11 | 50007 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $50 million. That figure was $74 million in PGC’s case. El Pollo LoCo Holdings Inc (NASDAQ:LOCO) is the most popular stock in this table. On the other hand REX American Resources Corp (NYSE:REX) is the least popular one with only 6 bullish hedge fund positions. Peapack-Gladstone Financial Corp (NASDAQ:PGC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on PGC as the stock returned 7.3% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.