Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index ETF (SPY) lost 8.7% through October 26th. Forty percent of the S&P 500 constituents were down more than 10%. The average return of a randomly picked stock in the index is -9.5%. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 25 most popular S&P 500 stocks among hedge funds had an average loss of 8.8%. In this article, we will take a look at what hedge funds think about Peapack-Gladstone Financial Corp (NASDAQ:PGC).

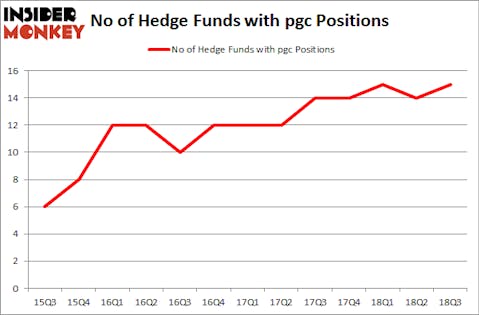

Peapack-Gladstone Financial Corp (NASDAQ:PGC) was in 15 hedge funds’ portfolios at the end of the third quarter of 2018. PGC investors should be aware of an increase in hedge fund sentiment recently. There were 14 hedge funds in our database with PGC holdings at the end of the previous quarter. Our calculations also showed that pgc isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a peek at the key hedge fund action regarding Peapack-Gladstone Financial Corp (NASDAQ:PGC).

How have hedgies been trading Peapack-Gladstone Financial Corp (NASDAQ:PGC)?

Heading into the fourth quarter of 2018, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from the second quarter of 2018. By comparison, 14 hedge funds held shares or bullish call options in PGC heading into this year. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

The largest stake in Peapack-Gladstone Financial Corp (NASDAQ:PGC) was held by Basswood Capital, which reported holding $28.9 million worth of stock at the end of September. It was followed by Endicott Management with a $15.4 million position. Other investors bullish on the company included Royce & Associates, Renaissance Technologies, and Mendon Capital Advisors.

With a general bullishness amongst the heavyweights, some big names have jumped into Peapack-Gladstone Financial Corp (NASDAQ:PGC) headfirst. Citadel Investment Group, managed by Ken Griffin, created the most outsized position in Peapack-Gladstone Financial Corp (NASDAQ:PGC). Citadel Investment Group had $0.7 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $0.2 million investment in the stock during the quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Peapack-Gladstone Financial Corp (NASDAQ:PGC) but similarly valued. We will take a look at First Trust MLP and Energy Income Fund (NYSE:FEI), Nuveen Intermediate Duration Municipal Term Fund (NYSE:NID), Ra Pharmaceuticals, Inc. (NASDAQ:RARX), and Aduro BioTech Inc (NASDAQ:ADRO). This group of stocks’ market values resemble PGC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FEI | 2 | 591 | 1 |

| NID | 2 | 1946 | -1 |

| RARX | 15 | 142343 | 4 |

| ADRO | 7 | 21488 | -1 |

| Average | 6.5 | 41592 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.5 hedge funds with bullish positions and the average amount invested in these stocks was $42 million. That figure was $93 million in PGC’s case. Ra Pharmaceuticals, Inc. (NASDAQ:RARX) is the most popular stock in this table. On the other hand First Trust MLP and Energy Income Fund (NYSE:FEI) is the least popular one with only 2 bullish hedge fund positions. Peapack-Gladstone Financial Corp (NASDAQ:PGC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard RARX might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.