The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 821 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of March 31st, 2020. In this article we are going to take a look at smart money sentiment towards Nextera Energy Partners LP (NYSE:NEP).

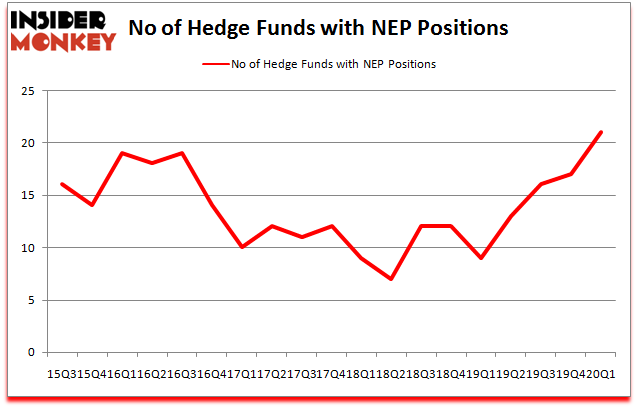

Is Nextera Energy Partners LP (NYSE:NEP) the right investment to pursue these days? The smart money is becoming more confident. The number of long hedge fund bets advanced by 4 recently. Our calculations also showed that NEP isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To most investors, hedge funds are viewed as worthless, outdated investment tools of years past. While there are over 8000 funds in operation at present, Our researchers look at the masters of this club, about 850 funds. These hedge fund managers control the lion’s share of the hedge fund industry’s total asset base, and by observing their finest equity investments, Insider Monkey has identified numerous investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Bernard Lambilliotte of Ecofin Ltd

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020’s unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out trades like this one. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to take a peek at the latest hedge fund action encompassing Nextera Energy Partners LP (NYSE:NEP).

What have hedge funds been doing with Nextera Energy Partners LP (NYSE:NEP)?

Heading into the second quarter of 2020, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 24% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards NEP over the last 18 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Nextera Energy Partners LP (NYSE:NEP) was held by Electron Capital Partners, which reported holding $29.4 million worth of stock at the end of September. It was followed by Yaupon Capital with a $7.6 million position. Other investors bullish on the company included Arrowstreet Capital, Ecofin Ltd, and PEAK6 Capital Management. In terms of the portfolio weights assigned to each position Yaupon Capital allocated the biggest weight to Nextera Energy Partners LP (NYSE:NEP), around 12.05% of its 13F portfolio. Electron Capital Partners is also relatively very bullish on the stock, designating 7.69 percent of its 13F equity portfolio to NEP.

As one would reasonably expect, some big names were breaking ground themselves. Arosa Capital Management, managed by Till Bechtolsheimer, initiated the largest position in Nextera Energy Partners LP (NYSE:NEP). Arosa Capital Management had $5.4 million invested in the company at the end of the quarter. John Bader’s Halcyon Asset Management also initiated a $4 million position during the quarter. The following funds were also among the new NEP investors: Matthew Hulsizer’s PEAK6 Capital Management, Greg Eisner’s Engineers Gate Manager, and D. E. Shaw’s D E Shaw.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Nextera Energy Partners LP (NYSE:NEP) but similarly valued. We will take a look at Agree Realty Corporation (NYSE:ADC), Brunswick Corporation (NYSE:BC), CVB Financial Corp. (NASDAQ:CVBF), and Ardagh Group S.A. (NYSE:ARD). This group of stocks’ market caps match NEP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ADC | 21 | 310469 | 3 |

| BC | 23 | 411459 | -13 |

| CVBF | 8 | 40046 | -6 |

| ARD | 8 | 48967 | -1 |

| Average | 15 | 202735 | -4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $203 million. That figure was $97 million in NEP’s case. Brunswick Corporation (NYSE:BC) is the most popular stock in this table. On the other hand CVB Financial Corp. (NASDAQ:CVBF) is the least popular one with only 8 bullish hedge fund positions. Nextera Energy Partners LP (NYSE:NEP) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.2% in 2020 through June 17th but still beat the market by 14.8 percentage points. Hedge funds were also right about betting on NEP, though not to the same extent, as the stock returned 22.9% during the first two months and seventeen days of the second quarter and outperformed the market as well.

Follow Xplr Infrastructure Lp (NYSE:XIFR)

Follow Xplr Infrastructure Lp (NYSE:XIFR)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.