Is Nextera Energy Partners LP (NYSE:NEP) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

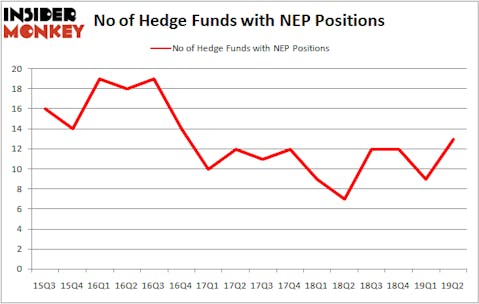

Nextera Energy Partners LP (NYSE:NEP) investors should be aware of an increase in hedge fund sentiment of late. NEP was in 13 hedge funds’ portfolios at the end of the second quarter of 2019. There were 9 hedge funds in our database with NEP holdings at the end of the previous quarter. Our calculations also showed that NEP isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the new hedge fund action regarding Nextera Energy Partners LP (NYSE:NEP).

What have hedge funds been doing with Nextera Energy Partners LP (NYSE:NEP)?

Heading into the third quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 44% from the first quarter of 2019. On the other hand, there were a total of 7 hedge funds with a bullish position in NEP a year ago. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

The largest stake in Nextera Energy Partners LP (NYSE:NEP) was held by Point72 Asset Management, which reported holding $14.6 million worth of stock at the end of March. It was followed by Ecofin Ltd with a $13.9 million position. Other investors bullish on the company included Millennium Management, ExodusPoint Capital, and Wexford Capital.

Now, specific money managers were breaking ground themselves. Point72 Asset Management, managed by Steve Cohen, assembled the most outsized position in Nextera Energy Partners LP (NYSE:NEP). Point72 Asset Management had $14.6 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $4.8 million investment in the stock during the quarter. The following funds were also among the new NEP investors: Michael Gelband’s ExodusPoint Capital, Charles Davidson and Joseph Jacobs’s Wexford Capital, and Renaissance Technologies.

Let’s now review hedge fund activity in other stocks similar to Nextera Energy Partners LP (NYSE:NEP). These stocks are Cogent Communications Holdings, Inc. (NASDAQ:CCOI), Fulton Financial Corp (NASDAQ:FULT), Wingstop Inc (NASDAQ:WING), and Pan American Silver Corp. (NASDAQ:PAAS). All of these stocks’ market caps are similar to NEP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CCOI | 18 | 286498 | -1 |

| FULT | 14 | 34700 | -2 |

| WING | 24 | 325201 | 0 |

| PAAS | 17 | 235406 | 0 |

| Average | 18.25 | 220451 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $220 million. That figure was $51 million in NEP’s case. Wingstop Inc (NASDAQ:WING) is the most popular stock in this table. On the other hand Fulton Financial Corp (NASDAQ:FULT) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Nextera Energy Partners LP (NYSE:NEP) is even less popular than FULT. Hedge funds clearly dropped the ball on NEP as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on NEP as the stock returned 10.6% during the third quarter and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.