Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Things completely reversed during the first quarter. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Marchex, Inc. (NASDAQ:MCHX) to find out whether it was one of their high conviction long-term ideas.

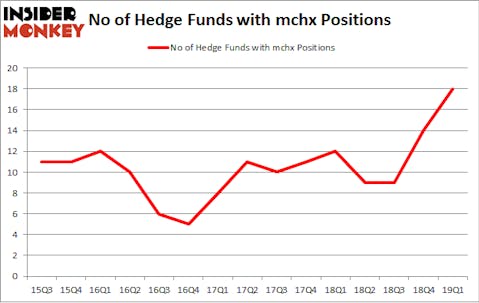

Marchex, Inc. (NASDAQ:MCHX) shareholders have witnessed an increase in hedge fund interest in recent months. MCHX was in 18 hedge funds’ portfolios at the end of the first quarter of 2019. There were 14 hedge funds in our database with MCHX holdings at the end of the previous quarter. Our calculations also showed that mchx isn’t among the 30 most popular stocks among hedge funds.

Today there are many tools stock traders employ to evaluate their stock investments. A couple of the less utilized tools are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the best hedge fund managers can outclass the S&P 500 by a solid margin (see the details here).

Let’s take a look at the latest hedge fund action surrounding Marchex, Inc. (NASDAQ:MCHX).

How are hedge funds trading Marchex, Inc. (NASDAQ:MCHX)?

Heading into the second quarter of 2019, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a change of 29% from the fourth quarter of 2018. By comparison, 12 hedge funds held shares or bullish call options in MCHX a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Marchex, Inc. (NASDAQ:MCHX), with a stake worth $9.9 million reported as of the end of March. Trailing Renaissance Technologies was Ancora Advisors, which amassed a stake valued at $6.7 million. Harbert Management, P.A.W. CAPITAL PARTNERS, and Royce & Associates were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, specific money managers have jumped into Marchex, Inc. (NASDAQ:MCHX) headfirst. Manatuck Hill Partners, managed by Mark Broach, established the largest position in Marchex, Inc. (NASDAQ:MCHX). Manatuck Hill Partners had $0.7 million invested in the company at the end of the quarter. Joseph Mathias’s Concourse Capital Management also made a $0.7 million investment in the stock during the quarter. The following funds were also among the new MCHX investors: Michael Gelband’s ExodusPoint Capital, Brian C. Freckmann’s Lyon Street Capital, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Marchex, Inc. (NASDAQ:MCHX) but similarly valued. These stocks are BioTime, Inc. (NYSE:BTX), Lifetime Brands Inc (NASDAQ:LCUT), First Internet Bancorp (NASDAQ:INBK), and Pfenex Inc (NYSE:PFNX). All of these stocks’ market caps are closest to MCHX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BTX | 4 | 44618 | -2 |

| LCUT | 3 | 17296 | 0 |

| INBK | 2 | 1189 | -1 |

| PFNX | 13 | 28678 | 3 |

| Average | 5.5 | 22945 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.5 hedge funds with bullish positions and the average amount invested in these stocks was $23 million. That figure was $37 million in MCHX’s case. Pfenex Inc (NYSE:PFNX) is the most popular stock in this table. On the other hand First Internet Bancorp (NASDAQ:INBK) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Marchex, Inc. (NASDAQ:MCHX) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately MCHX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MCHX were disappointed as the stock returned -2.5% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.