Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ complex research processes to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space. Nevertheless, it is also possible to find underpriced large-cap stocks by following the hedge funds’ moves.

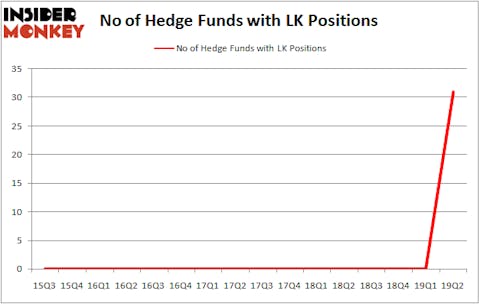

Is Luckin Coffee Inc. (NASDAQ:LK) a buy right now? Prominent investors are becoming more confident. The number of bullish hedge fund positions advanced by 31 lately. Our calculations also showed that LK isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are dozens of indicators market participants have at their disposal to size up publicly traded companies. Two of the less known indicators are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the elite investment managers can beat the S&P 500 by a solid amount (see the details here).

We’re going to take a gander at the fresh hedge fund action encompassing Luckin Coffee Inc. (NASDAQ:LK).

Hedge fund activity in Luckin Coffee Inc. (NASDAQ:LK)

At Q2’s end, a total of 31 of the hedge funds tracked by Insider Monkey were long this stock, a change of 31 from the previous quarter. On the other hand, there were a total of 0 hedge funds with a bullish position in LK a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Luckin Coffee Inc. (NASDAQ:LK) was held by Alkeon Capital Management, which reported holding $57.9 million worth of stock at the end of March. It was followed by Melvin Capital Management with a $51.6 million position. Other investors bullish on the company included Darsana Capital Partners, Maplelane Capital, and Point72 Asset Management.

As industrywide interest jumped, key money managers were breaking ground themselves. Alkeon Capital Management, managed by Panayotis Takis Sparaggis, assembled the largest position in Luckin Coffee Inc. (NASDAQ:LK). Alkeon Capital Management had $57.9 million invested in the company at the end of the quarter. Gabriel Plotkin’s Melvin Capital Management also initiated a $51.6 million position during the quarter. The other funds with new positions in the stock are Anand Desai’s Darsana Capital Partners, Leon Shaulov’s Maplelane Capital, and Steve Cohen’s Point72 Asset Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Luckin Coffee Inc. (NASDAQ:LK) but similarly valued. We will take a look at WPX Energy Inc (NYSE:WPX), Horizon Therapeutics Public Limited Company (NASDAQ:HZNP), Air Lease Corp (NYSE:AL), and Life Storage, Inc. (NYSE:LSI). All of these stocks’ market caps resemble LK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WPX | 40 | 726310 | -2 |

| HZNP | 34 | 1221612 | -7 |

| AL | 18 | 320553 | -5 |

| LSI | 20 | 349068 | 5 |

| Average | 28 | 654386 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $654 million. That figure was $379 million in LK’s case. WPX Energy Inc (NYSE:WPX) is the most popular stock in this table. On the other hand Air Lease Corp (NYSE:AL) is the least popular one with only 18 bullish hedge fund positions. Luckin Coffee Inc. (NASDAQ:LK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately LK wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on LK were disappointed as the stock returned -2.5% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.