Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

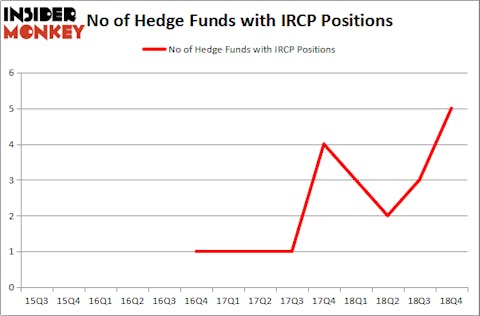

Is IRSA Propiedades Comerciales S.A. (NASDAQ:IRCP) a superb investment right now? The best stock pickers are in a bullish mood. The number of long hedge fund bets moved up by 2 lately. Our calculations also showed that IRCP isn’t among the 30 most popular stocks among hedge funds. IRCP was in 5 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 3 hedge funds in our database with IRCP holdings at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the new hedge fund action surrounding IRSA Propiedades Comerciales S.A. (NASDAQ:IRCP).

How have hedgies been trading IRSA Propiedades Comerciales S.A. (NASDAQ:IRCP)?

At the end of the fourth quarter, a total of 5 of the hedge funds tracked by Insider Monkey were long this stock, a change of 67% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards IRCP over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Rima Senvest Management was the largest shareholder of IRSA Propiedades Comerciales S.A. (NASDAQ:IRCP), with a stake worth $8.2 million reported as of the end of December. Trailing Rima Senvest Management was Autonomy Capital, which amassed a stake valued at $1.4 million. 683 Capital Partners, Brigade Capital, and Marathon Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, specific money managers have been driving this bullishness. Autonomy Capital, managed by Robert Charles Gibbins, established the most valuable position in IRSA Propiedades Comerciales S.A. (NASDAQ:IRCP). Autonomy Capital had $1.4 million invested in the company at the end of the quarter. Bruce J. Richards and Louis Hanover’s Marathon Asset Management also initiated a $0 million position during the quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as IRSA Propiedades Comerciales S.A. (NASDAQ:IRCP) but similarly valued. We will take a look at Coherus Biosciences Inc (NASDAQ:CHRS), Central Securities Corporation (NYSE:CET), Care.com Inc (NYSE:CRCM), and Tuniu Corporation (NASDAQ:TOUR). This group of stocks’ market caps resemble IRCP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHRS | 20 | 106981 | -3 |

| CET | 2 | 14038 | -1 |

| CRCM | 17 | 174305 | -2 |

| TOUR | 5 | 33046 | 2 |

| Average | 11 | 82093 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $82 million. That figure was $11 million in IRCP’s case. Coherus Biosciences Inc (NASDAQ:CHRS) is the most popular stock in this table. On the other hand Central Securities Corporation (NYSE:CET) is the least popular one with only 2 bullish hedge fund positions. IRSA Propiedades Comerciales S.A. (NASDAQ:IRCP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately IRCP wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); IRCP investors were disappointed as the stock returned 3.7% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.