Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before last year’s Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first half of 2019, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first half still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to IES Holdings, Inc. (NASDAQ:IESC) changed recently.

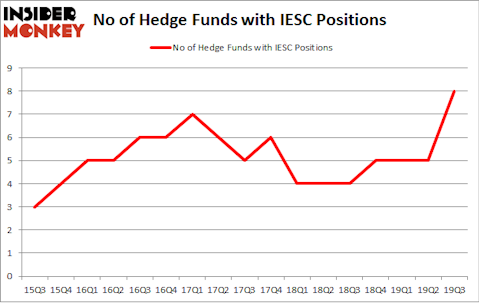

IES Holdings, Inc. (NASDAQ:IESC) has seen an increase in activity from the world’s largest hedge funds in recent months. IESC was in 8 hedge funds’ portfolios at the end of September. There were 5 hedge funds in our database with IESC holdings at the end of the previous quarter. Our calculations also showed that IESC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are many metrics stock market investors put to use to grade publicly traded companies. A duo of the most innovative metrics are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the elite fund managers can outperform the broader indices by a superb margin (see the details here).

Chuck Royce of Royce & Associates

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the fresh hedge fund action encompassing IES Holdings, Inc. (NASDAQ:IESC).

What have hedge funds been doing with IES Holdings, Inc. (NASDAQ:IESC)?

At Q3’s end, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 60% from the previous quarter. The graph below displays the number of hedge funds with bullish position in IESC over the last 17 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

The largest stake in IES Holdings, Inc. (NASDAQ:IESC) was held by Tontine Asset Management, which reported holding $248.9 million worth of stock at the end of September. It was followed by Royce & Associates with a $17.5 million position. Other investors bullish on the company included Renaissance Technologies, Millennium Management, and Winton Capital Management. In terms of the portfolio weights assigned to each position Tontine Asset Management allocated the biggest weight to IES Holdings, Inc. (NASDAQ:IESC), around 35.5% of its 13F portfolio. Royce & Associates is also relatively very bullish on the stock, designating 0.16 percent of its 13F equity portfolio to IESC.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Winton Capital Management, managed by David Harding, initiated the biggest position in IES Holdings, Inc. (NASDAQ:IESC). Winton Capital Management had $0.7 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $0.6 million position during the quarter. The only other fund with a new position in the stock is Ken Griffin’s Citadel Investment Group.

Let’s also examine hedge fund activity in other stocks similar to IES Holdings, Inc. (NASDAQ:IESC). These stocks are Progenics Pharmaceuticals, Inc. (NASDAQ:PGNX), Lydall, Inc. (NYSE:LDL), CNB Financial Corporation (NASDAQ:CCNE), and The Cato Corporation (NYSE:CATO). This group of stocks’ market values resemble IESC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PGNX | 12 | 69681 | -1 |

| LDL | 13 | 23112 | 1 |

| CCNE | 3 | 30012 | 1 |

| CATO | 14 | 36788 | -4 |

| Average | 10.5 | 39898 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $40 million. That figure was $275 million in IESC’s case. The Cato Corporation (NYSE:CATO) is the most popular stock in this table. On the other hand CNB Financial Corporation (NASDAQ:CCNE) is the least popular one with only 3 bullish hedge fund positions. IES Holdings, Inc. (NASDAQ:IESC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately IESC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); IESC investors were disappointed as the stock returned 5.3% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.