Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ recent losses in Facebook. Let’s take a closer look at what the funds we track think about Federal Signal Corporation (NYSE:FSS) in this article.

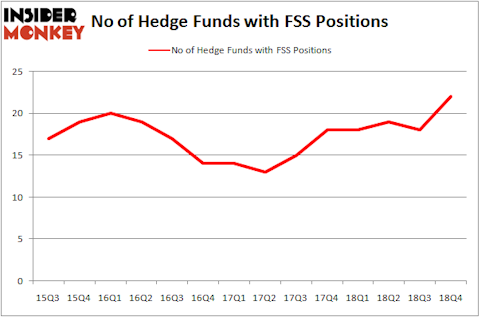

Federal Signal Corporation (NYSE:FSS) investors should be aware of an increase in hedge fund interest in recent months. Our calculations also showed that FSS isn’t among the 30 most popular stocks among hedge funds.

According to most investors, hedge funds are viewed as slow, old investment tools of years past. While there are more than 8000 funds trading at present, We choose to focus on the aristocrats of this club, approximately 750 funds. It is estimated that this group of investors manage most of the smart money’s total asset base, and by observing their highest performing picks, Insider Monkey has found many investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s go over the new hedge fund action regarding Federal Signal Corporation (NYSE:FSS).

How have hedgies been trading Federal Signal Corporation (NYSE:FSS)?

At Q4’s end, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 22% from one quarter earlier. On the other hand, there were a total of 18 hedge funds with a bullish position in FSS a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Federal Signal Corporation (NYSE:FSS) was held by GAMCO Investors, which reported holding $15.8 million worth of stock at the end of December. It was followed by Royce & Associates with a $10.1 million position. Other investors bullish on the company included Millennium Management, Impax Asset Management, and Citadel Investment Group.

With a general bullishness amongst the heavyweights, key hedge funds were breaking ground themselves. GLG Partners, managed by Noam Gottesman, assembled the most valuable position in Federal Signal Corporation (NYSE:FSS). GLG Partners had $1.1 million invested in the company at the end of the quarter. David Costen Haley’s HBK Investments also initiated a $0.8 million position during the quarter. The following funds were also among the new FSS investors: Brandon Haley’s Holocene Advisors, Minhua Zhang’s Weld Capital Management, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s go over hedge fund activity in other stocks similar to Federal Signal Corporation (NYSE:FSS). We will take a look at Cardtronics plc (NASDAQ:CATM), First Busey Corporation (NASDAQ:BUSE), Empresa Distribuidora y Comercializadora Norte Sociedad Anónima (NYSE:EDN), and LivePerson, Inc. (NASDAQ:LPSN). All of these stocks’ market caps resemble FSS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CATM | 18 | 291296 | 0 |

| BUSE | 12 | 33593 | -2 |

| EDN | 6 | 19637 | -1 |

| LPSN | 17 | 131255 | 5 |

| Average | 13.25 | 118945 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $119 million. That figure was $71 million in FSS’s case. Cardtronics plc (NASDAQ:CATM) is the most popular stock in this table. On the other hand Empresa Distribuidora y Comercializadora Norte Sociedad Anónima (NYSE:EDN) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Federal Signal Corporation (NYSE:FSS) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on FSS as the stock returned 40.4% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.