We at Insider Monkey have gone over 738 13F filings that hedge funds and famous value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article we look at what those investors think of Ebix Inc (NASDAQ:EBIX).

Ebix Inc (NASDAQ:EBIX) investors should be aware of an increase in hedge fund interest recently. Our calculations also showed that EBIX isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are a multitude of methods stock market investors have at their disposal to assess publicly traded companies. A couple of the most underrated methods are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the best money managers can outclass their index-focused peers by a significant amount (see the details here).

Let’s take a look at the new hedge fund action surrounding Ebix Inc (NASDAQ:EBIX).

How are hedge funds trading Ebix Inc (NASDAQ:EBIX)?

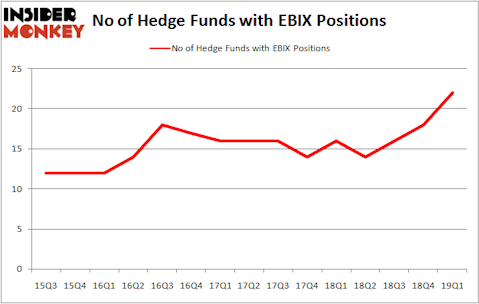

Heading into the second quarter of 2019, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of 22% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards EBIX over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, P2 Capital Partners held the most valuable stake in Ebix Inc (NASDAQ:EBIX), which was worth $71.3 million at the end of the first quarter. On the second spot was Marshall Wace LLP which amassed $23.4 million worth of shares. Moreover, Cadian Capital, Barington Capital Group, and Citadel Investment Group were also bullish on Ebix Inc (NASDAQ:EBIX), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, some big names have jumped into Ebix Inc (NASDAQ:EBIX) headfirst. Concourse Capital Management, managed by Joseph Mathias, established the biggest position in Ebix Inc (NASDAQ:EBIX). Concourse Capital Management had $1.1 million invested in the company at the end of the quarter. James Dondero’s Highland Capital Management also initiated a $0.8 million position during the quarter. The other funds with brand new EBIX positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Minhua Zhang’s Weld Capital Management, and Adam Usdan’s Trellus Management Company.

Let’s check out hedge fund activity in other stocks similar to Ebix Inc (NASDAQ:EBIX). These stocks are Freshpet Inc (NASDAQ:FRPT), Eventbrite, Inc. (NYSE:EB), Wageworks Inc (NYSE:WAGE), and Usa Compression Partners LP (NYSE:USAC). This group of stocks’ market caps match EBIX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FRPT | 25 | 117770 | 4 |

| EB | 16 | 356225 | 8 |

| WAGE | 21 | 160164 | 8 |

| USAC | 5 | 9108 | 0 |

| Average | 16.75 | 160817 | 5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $161 million. That figure was $154 million in EBIX’s case. Freshpet Inc (NASDAQ:FRPT) is the most popular stock in this table. On the other hand Usa Compression Partners LP (NYSE:USAC) is the least popular one with only 5 bullish hedge fund positions. Ebix Inc (NASDAQ:EBIX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on EBIX, though not to the same extent, as the stock returned 1.6% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.