Is CVB Financial Corp. (NASDAQ:CVBF) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

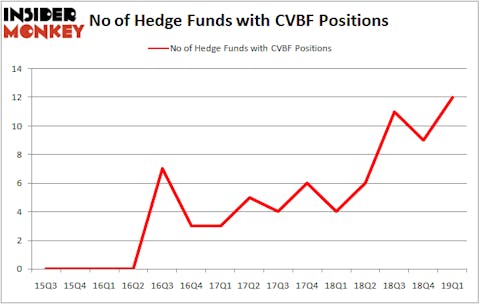

CVB Financial Corp. (NASDAQ:CVBF) was in 12 hedge funds’ portfolios at the end of the first quarter of 2019. CVBF has seen an increase in hedge fund interest in recent months. There were 9 hedge funds in our database with CVBF positions at the end of the previous quarter. Our calculations also showed that CVBF isn’t among the 30 most popular stocks among hedge funds.

At the moment there are plenty of gauges shareholders put to use to assess publicly traded companies. A pair of the most under-the-radar gauges are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the top money managers can outperform the market by a superb amount (see the details here).

We’re going to take a look at the latest hedge fund action regarding CVB Financial Corp. (NASDAQ:CVBF).

What have hedge funds been doing with CVB Financial Corp. (NASDAQ:CVBF)?

Heading into the second quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 33% from the previous quarter. On the other hand, there were a total of 4 hedge funds with a bullish position in CVBF a year ago. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Ken Griffin’s Citadel Investment Group has the biggest position in CVB Financial Corp. (NASDAQ:CVBF), worth close to $15.5 million, amounting to less than 0.1%% of its total 13F portfolio. Sitting at the No. 2 spot is Balyasny Asset Management, led by Dmitry Balyasny, holding a $6.9 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions include Jim Simons’s Renaissance Technologies, D. E. Shaw’s D E Shaw and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. Citadel Investment Group, managed by Ken Griffin, established the most outsized position in CVB Financial Corp. (NASDAQ:CVBF). Citadel Investment Group had $15.5 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $2.1 million investment in the stock during the quarter. The following funds were also among the new CVBF investors: Benjamin A. Smith’s Laurion Capital Management, Israel Englander’s Millennium Management, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s also examine hedge fund activity in other stocks similar to CVB Financial Corp. (NASDAQ:CVBF). These stocks are Chemical Financial Corporation (NASDAQ:CHFC), UniFirst Corp (NYSE:UNF), NuVasive, Inc. (NASDAQ:NUVA), and White Mountains Insurance Group Ltd (NYSE:WTM). This group of stocks’ market valuations are closest to CVBF’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHFC | 18 | 96012 | 8 |

| UNF | 21 | 163958 | 7 |

| NUVA | 20 | 248855 | 0 |

| WTM | 16 | 161311 | -2 |

| Average | 18.75 | 167534 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $168 million. That figure was $41 million in CVBF’s case. UniFirst Corp (NYSE:UNF) is the most popular stock in this table. On the other hand White Mountains Insurance Group Ltd (NYSE:WTM) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks CVB Financial Corp. (NASDAQ:CVBF) is even less popular than WTM. Hedge funds dodged a bullet by taking a bearish stance towards CVBF. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately CVBF wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); CVBF investors were disappointed as the stock returned 1.9% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.