Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The last 12 months is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Consolidated Edison, Inc. (NYSE:ED).

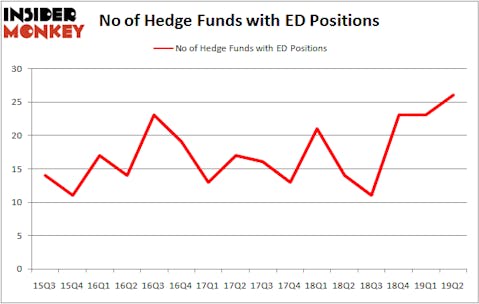

Is Consolidated Edison, Inc. (NYSE:ED) the right pick for your portfolio? Prominent investors are becoming hopeful. The number of bullish hedge fund positions went up by 3 recently. Our calculations also showed that ED isn’t among the 30 most popular stocks among hedge funds.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most traders, hedge funds are perceived as slow, outdated investment tools of yesteryear. While there are over 8000 funds with their doors open today, Our researchers choose to focus on the elite of this group, around 750 funds. Most estimates calculate that this group of people oversee the majority of the hedge fund industry’s total asset base, and by keeping track of their finest picks, Insider Monkey has revealed a number of investment strategies that have historically outstripped Mr. Market. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by around 5 percentage points annually since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s go over the fresh hedge fund action surrounding Consolidated Edison, Inc. (NYSE:ED).

How are hedge funds trading Consolidated Edison, Inc. (NYSE:ED)?

Heading into the third quarter of 2019, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ED over the last 16 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, AQR Capital Management was the largest shareholder of Consolidated Edison, Inc. (NYSE:ED), with a stake worth $406.3 million reported as of the end of March. Trailing AQR Capital Management was Renaissance Technologies, which amassed a stake valued at $317.4 million. Citadel Investment Group, D E Shaw, and Two Sigma Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key money managers have jumped into Consolidated Edison, Inc. (NYSE:ED) headfirst. Luminus Management, managed by Jonathan Barrett and Paul Segal, assembled the biggest position in Consolidated Edison, Inc. (NYSE:ED). Luminus Management had $63.1 million invested in the company at the end of the quarter. Stuart J. Zimmer’s Zimmer Partners also initiated a $57.8 million position during the quarter. The other funds with brand new ED positions are Phill Gross and Robert Atchinson’s Adage Capital Management, Perella Weinberg Partners, and David Andre and Astro Teller’s Cerebellum Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Consolidated Edison, Inc. (NYSE:ED) but similarly valued. These stocks are Equity Residential (NYSE:EQR), AvalonBay Communities Inc (NYSE:AVB), ONEOK, Inc. (NYSE:OKE), and Chunghwa Telecom Co., Ltd (NYSE:CHT). This group of stocks’ market values match ED’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EQR | 23 | 223216 | 1 |

| AVB | 21 | 662423 | -5 |

| OKE | 21 | 380798 | 7 |

| CHT | 3 | 120183 | -1 |

| Average | 17 | 346655 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $347 million. That figure was $1402 million in ED’s case. Equity Residential (NYSE:EQR) is the most popular stock in this table. On the other hand Chunghwa Telecom Co., Ltd (NYSE:CHT) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Consolidated Edison, Inc. (NYSE:ED) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on ED as the stock returned 8.7% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.