The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Consolidated Edison, Inc. (NYSE:ED).

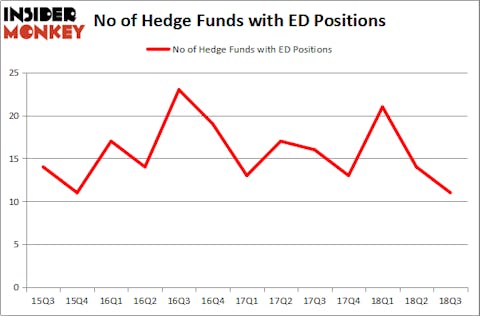

Is Consolidated Edison, Inc. (NYSE:ED) a buy right now? Investors who are in the know are getting less optimistic. The number of bullish hedge fund bets went down by 3 lately. Our calculations also showed that ED isn’t among the 30 most popular stocks among hedge funds. ED was in 11 hedge funds’ portfolios at the end of the third quarter of 2018. There were 14 hedge funds in our database with ED positions at the end of the previous quarter.

In the financial world there are a lot of methods market participants can use to grade publicly traded companies. A pair of the best methods are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the elite fund managers can outperform the S&P 500 by a significant amount (see the details here).

We’re going to take a look at the new hedge fund action regarding Consolidated Edison, Inc. (NYSE:ED).

What does the smart money think about Consolidated Edison, Inc. (NYSE:ED)?

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -21% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ED over the last 13 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

The largest stake in Consolidated Edison, Inc. (NYSE:ED) was held by AQR Capital Management, which reported holding $727.7 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $232.5 million position. Other investors bullish on the company included Two Sigma Advisors, GLG Partners, and PEAK6 Capital Management.

Seeing as Consolidated Edison, Inc. (NYSE:ED) has experienced falling interest from the entirety of the hedge funds we track, we can see that there exists a select few hedgies that decided to sell off their full holdings heading into Q3. Interestingly, Sara Nainzadeh’s Centenus Global Management said goodbye to the largest stake of all the hedgies monitored by Insider Monkey, totaling an estimated $16.4 million in stock. John Brandmeyer’s fund, Cognios Capital, also dumped its stock, about $2.6 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 3 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Consolidated Edison, Inc. (NYSE:ED) but similarly valued. These stocks are M&T Bank Corporation (NYSE:MTB), Republic Services, Inc. (NYSE:RSG), Wipro Limited (NYSE:WIT), and Deutsche Bank Aktiengesellschaft (NYSE:DB). This group of stocks’ market valuations match ED’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MTB | 41 | 2338443 | 2 |

| RSG | 26 | 610706 | 4 |

| WIT | 8 | 67451 | 2 |

| DB | 9 | 1416896 | 0 |

| Average | 21 | 1108374 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $1.11 billion. That figure was $1.00 billion in ED’s case. M&T Bank Corporation (NYSE:MTB) is the most popular stock in this table. On the other hand Wipro Limited (NYSE:WIT) is the least popular one with only 8 bullish hedge fund positions. Consolidated Edison, Inc. (NYSE:ED) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MTB might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.