World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

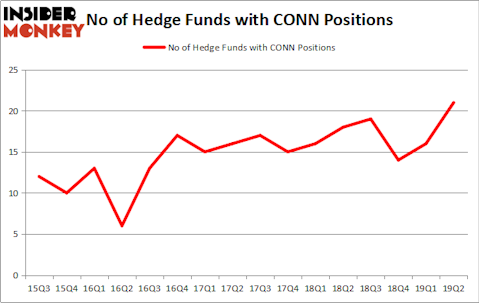

Conn’s, Inc. (NASDAQ:CONN) investors should be aware of an increase in hedge fund sentiment recently. CONN was in 21 hedge funds’ portfolios at the end of June. There were 16 hedge funds in our database with CONN holdings at the end of the previous quarter. Our calculations also showed that CONN isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most investors, hedge funds are perceived as worthless, old investment tools of yesteryear. While there are greater than 8000 funds in operation at present, Our experts look at the crème de la crème of this group, about 750 funds. These investment experts handle the majority of the smart money’s total capital, and by keeping track of their highest performing investments, Insider Monkey has found a number of investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. Now we’re going to take a peek at the latest hedge fund action regarding Conn’s, Inc. (NASDAQ:CONN).

Hedge fund activity in Conn’s, Inc. (NASDAQ:CONN)

At the end of the second quarter, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 31% from one quarter earlier. By comparison, 18 hedge funds held shares or bullish call options in CONN a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Anchorage Advisors held the most valuable stake in Conn’s, Inc. (NASDAQ:CONN), which was worth $51.7 million at the end of the second quarter. On the second spot was Portolan Capital Management which amassed $8 million worth of shares. Moreover, Buckingham Capital Management, SG Capital Management, and Marshall Wace LLP were also bullish on Conn’s, Inc. (NASDAQ:CONN), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, key money managers have jumped into Conn’s, Inc. (NASDAQ:CONN) headfirst. SG Capital Management, managed by Ken Grossman and Glen Schneider, established the largest position in Conn’s, Inc. (NASDAQ:CONN). SG Capital Management had $6.8 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also made a $1 million investment in the stock during the quarter. The other funds with brand new CONN positions are David Harding’s Winton Capital Management, Alec Litowitz and Ross Laser’s Magnetar Capital, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Conn’s, Inc. (NASDAQ:CONN) but similarly valued. We will take a look at Bridge Bancorp, Inc. (NASDAQ:BDGE), Nexgen Energy Ltd. (NYSE:NXE), One Liberty Properties, Inc. (NYSE:OLP), and Gran Tierra Energy Inc. (NYSEAMEX:GTE). This group of stocks’ market values resemble CONN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BDGE | 10 | 95847 | -1 |

| NXE | 8 | 27179 | 0 |

| OLP | 4 | 29008 | 0 |

| GTE | 13 | 217180 | -3 |

| Average | 8.75 | 92304 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.75 hedge funds with bullish positions and the average amount invested in these stocks was $92 million. That figure was $96 million in CONN’s case. Gran Tierra Energy Inc. (NYSEAMEX:GTE) is the most popular stock in this table. On the other hand One Liberty Properties, Inc. (NYSE:OLP) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Conn’s, Inc. (NASDAQ:CONN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on CONN as the stock returned 39.5% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.