The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the first quarter, which unveil their equity positions as of March 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Centene Corp (NYSE:CNC).

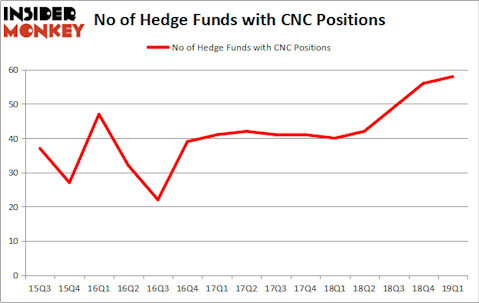

Centene Corp (NYSE:CNC) investors should pay attention to an increase in hedge fund sentiment of late. Our calculations also showed that CNC isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are a lot of metrics investors use to analyze stocks. Some of the less known metrics are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the top hedge fund managers can beat the broader indices by a solid margin (see the details here).

Let’s view the new hedge fund action regarding Centene Corp (NYSE:CNC).

How are hedge funds trading Centene Corp (NYSE:CNC)?

At Q1’s end, a total of 58 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the fourth quarter of 2018. By comparison, 40 hedge funds held shares or bullish call options in CNC a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, AQR Capital Management, managed by Cliff Asness, holds the number one position in Centene Corp (NYSE:CNC). AQR Capital Management has a $287.8 million position in the stock, comprising 0.3% of its 13F portfolio. Sitting at the No. 2 spot is Viking Global, managed by Andreas Halvorsen, which holds a $223 million position; 1.3% of its 13F portfolio is allocated to the stock. Other members of the smart money that are bullish encompass Lee Ainslie’s Maverick Capital, Ricky Sandler’s Eminence Capital and D. E. Shaw’s D E Shaw.

Now, some big names have jumped into Centene Corp (NYSE:CNC) headfirst. Paulson & Co, managed by John Paulson, assembled the largest position in Centene Corp (NYSE:CNC). Paulson & Co had $82.7 million invested in the company at the end of the quarter. Scott Ferguson’s Sachem Head Capital also initiated a $62.4 million position during the quarter. The following funds were also among the new CNC investors: Matthew Halbower’s Pentwater Capital Management, Larry Robbins’s Glenview Capital, and Daniel S. Och’s OZ Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Centene Corp (NYSE:CNC) but similarly valued. We will take a look at Verisk Analytics, Inc. (NASDAQ:VRSK), M&T Bank Corporation (NYSE:MTB), IHS Markit Ltd. (NASDAQ:INFO), and Verisign, Inc. (NASDAQ:VRSN). This group of stocks’ market values are similar to CNC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VRSK | 20 | 494091 | -10 |

| MTB | 36 | 1236608 | -6 |

| INFO | 30 | 1154869 | 3 |

| VRSN | 31 | 5137304 | 1 |

| Average | 29.25 | 2005718 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.25 hedge funds with bullish positions and the average amount invested in these stocks was $2006 million. That figure was $2068 million in CNC’s case. M&T Bank Corporation (NYSE:MTB) is the most popular stock in this table. On the other hand Verisk Analytics, Inc. (NASDAQ:VRSK) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Centene Corp (NYSE:CNC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on CNC as the stock returned 7.3% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.