Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 9 percentage points since the end of the third quarter of 2018 as investors worried over the possible ramifications of rising interest rates and escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Bristol Myers Squibb Company (NYSE:BMY) and see how the stock is affected by the recent hedge fund activity.

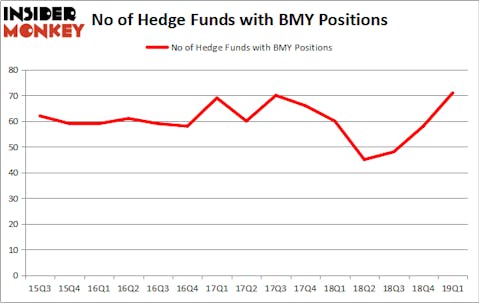

Bristol Myers Squibb Company (NYSE:BMY) investors should be aware of an increase in support from the world’s most elite money managers in recent months. BMY was in 71 hedge funds’ portfolios at the end of March. There were 58 hedge funds in our database with BMY positions at the end of the previous quarter. Our calculations also showed that BMY isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s go over the new hedge fund action regarding Bristol Myers Squibb Company (NYSE:BMY).

What have hedge funds been doing with Bristol Myers Squibb Company (NYSE:BMY)?

At Q1’s end, a total of 71 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 22% from the fourth quarter of 2018. On the other hand, there were a total of 60 hedge funds with a bullish position in BMY a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Arrowstreet Capital was the largest shareholder of Bristol Myers Squibb Company (NYSE:BMY), with a stake worth $703.2 million reported as of the end of March. Trailing Arrowstreet Capital was Renaissance Technologies, which amassed a stake valued at $589.3 million. AQR Capital Management, Two Sigma Advisors, and Pentwater Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, some big names have jumped into Bristol Myers Squibb Company (NYSE:BMY) headfirst. Pentwater Capital Management, managed by Matthew Halbower, created the largest call position in Bristol Myers Squibb Company (NYSE:BMY). Pentwater Capital Management had $298.9 million invested in the company at the end of the quarter. David Costen Haley’s HBK Investments also initiated a $194.2 million position during the quarter. The other funds with brand new BMY positions are Seth Klarman’s Baupost Group, Paul Singer’s Elliott Management, and Zach Schreiber’s Point State Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Bristol Myers Squibb Company (NYSE:BMY) but similarly valued. We will take a look at U.S. Bancorp (NYSE:USB), China Life Insurance Company Ltd. (NYSE:LFC), ConocoPhillips (NYSE:COP), and Banco Santander, S.A. (NYSE:SAN). This group of stocks’ market valuations resemble BMY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| USB | 44 | 6941152 | 3 |

| LFC | 7 | 38797 | 0 |

| COP | 54 | 2718979 | -5 |

| SAN | 23 | 690893 | 5 |

| Average | 32 | 2597455 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32 hedge funds with bullish positions and the average amount invested in these stocks was $2597 million. That figure was $4099 million in BMY’s case. ConocoPhillips (NYSE:COP) is the most popular stock in this table. On the other hand China Life Insurance Company Ltd. (NYSE:LFC) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Bristol Myers Squibb Company (NYSE:BMY) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately BMY wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BMY were disappointed as the stock returned -3% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.