Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Aqua America Inc (NYSE:WTR).

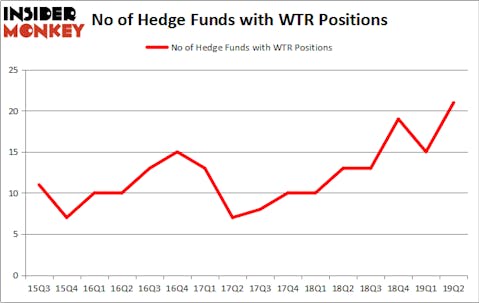

Aqua America Inc (NYSE:WTR) investors should be aware of an increase in enthusiasm from smart money lately. Our calculations also showed that WTR isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are several methods investors put to use to assess their stock investments. Two of the most underrated methods are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the best investment managers can outclass the market by a significant margin (see the details here).

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s analyze the new hedge fund action encompassing Aqua America Inc (NYSE:WTR).

How are hedge funds trading Aqua America Inc (NYSE:WTR)?

At Q2’s end, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 40% from one quarter earlier. On the other hand, there were a total of 13 hedge funds with a bullish position in WTR a year ago. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Among these funds, Zimmer Partners held the most valuable stake in Aqua America Inc (NYSE:WTR), which was worth $464 million at the end of the second quarter. On the second spot was Impax Asset Management which amassed $101 million worth of shares. Moreover, Millennium Management, Luminus Management, and Royce & Associates were also bullish on Aqua America Inc (NYSE:WTR), allocating a large percentage of their portfolios to this stock.

Now, key money managers were breaking ground themselves. Zimmer Partners, managed by Stuart J. Zimmer, established the most outsized position in Aqua America Inc (NYSE:WTR). Zimmer Partners had $464 million invested in the company at the end of the quarter. Jonathan Barrett and Paul Segal’s Luminus Management also made a $29.6 million investment in the stock during the quarter. The other funds with new positions in the stock are D. E. Shaw’s D E Shaw, Sara Nainzadeh’s Centenus Global Management, and Steve Pattyn’s Yaupon Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Aqua America Inc (NYSE:WTR) but similarly valued. We will take a look at Andeavor Logistics LP (NYSE:ANDX), China Southern Airlines Co Ltd (NYSE:ZNH), Bright Horizons Family Solutions Inc (NYSE:BFAM), and China Eastern Airlines Corp. Ltd. (NYSE:CEA). This group of stocks’ market caps are similar to WTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ANDX | 5 | 34262 | -1 |

| ZNH | 1 | 14307 | -2 |

| BFAM | 20 | 244568 | 2 |

| CEA | 1 | 1064 | 0 |

| Average | 6.75 | 73550 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $74 million. That figure was $726 million in WTR’s case. Bright Horizons Family Solutions Inc (NYSE:BFAM) is the most popular stock in this table. On the other hand China Southern Airlines Co Ltd (NYSE:ZNH) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Aqua America Inc (NYSE:WTR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on WTR as the stock returned 9% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.