Hedge funds are known to underperform the bull markets but that’s not because they are bad at investing. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. Hedge funds underperform because they are hedged. The Standard and Poor’s 500 Index returned approximately 13.1% in the first 2.5 months of this year (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. An average long/short hedge fund returned only 5% due to the hedges they implement and the large fees they charge. Our research covering the last 18 years indicates that investors can outperform the market by imitating hedge funds’ stock picks rather than directly investing in hedge funds. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Apellis Pharmaceuticals, Inc. (NASDAQ:APLS).

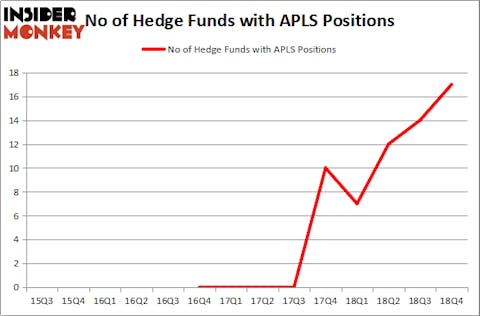

Is Apellis Pharmaceuticals, Inc. (NASDAQ:APLS) the right pick for your portfolio? Hedge funds are becoming more confident. The number of long hedge fund positions moved up by 3 recently. Our calculations also showed that APLS isn’t among the 30 most popular stocks among hedge funds. APLS was in 17 hedge funds’ portfolios at the end of December. There were 14 hedge funds in our database with APLS holdings at the end of the previous quarter.

According to most stock holders, hedge funds are assumed to be unimportant, outdated financial tools of years past. While there are greater than 8000 funds trading at the moment, We hone in on the leaders of this club, about 750 funds. These hedge fund managers watch over the lion’s share of the smart money’s total capital, and by tracking their inimitable investments, Insider Monkey has brought to light numerous investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a peek at the recent hedge fund action surrounding Apellis Pharmaceuticals, Inc. (NASDAQ:APLS).

What have hedge funds been doing with Apellis Pharmaceuticals, Inc. (NASDAQ:APLS)?

At Q4’s end, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 21% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards APLS over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Cormorant Asset Management, managed by Bihua Chen, holds the number one position in Apellis Pharmaceuticals, Inc. (NASDAQ:APLS). Cormorant Asset Management has a $59.4 million position in the stock, comprising 4.8% of its 13F portfolio. On Cormorant Asset Management’s heels is Sectoral Asset Management, led by Jerome Pfund and Michael Sjostrom, holding a $28.6 million position; 3.9% of its 13F portfolio is allocated to the stock. Remaining professional money managers that are bullish encompass Lei Zhang’s Hillhouse Capital Management, Israel Englander’s Millennium Management and Albert Cha and Frank Kung’s Vivo Capital.

As aggregate interest increased, specific money managers were breaking ground themselves. Vivo Capital, managed by Albert Cha and Frank Kung, assembled the biggest position in Apellis Pharmaceuticals, Inc. (NASDAQ:APLS). Vivo Capital had $11.5 million invested in the company at the end of the quarter. Samuel Isaly’s OrbiMed Advisors also initiated a $4.3 million position during the quarter. The other funds with new positions in the stock are Steve Cohen’s Point72 Asset Management, David Costen Haley’s HBK Investments, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now review hedge fund activity in other stocks similar to Apellis Pharmaceuticals, Inc. (NASDAQ:APLS). We will take a look at Herc Holdings Inc. (NYSE:HRI), Acorda Therapeutics Inc (NASDAQ:ACOR), Arlo Technologies, Inc. (NYSE:ARLO), and National Energy Services Reunited Corp. (NASDAQ:NESR). All of these stocks’ market caps match APLS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HRI | 27 | 323111 | 3 |

| ACOR | 22 | 180486 | 1 |

| ARLO | 8 | 9670 | -4 |

| NESR | 4 | 25193 | 0 |

| Average | 15.25 | 134615 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $135 million. That figure was $171 million in APLS’s case. Herc Holdings Inc. (NYSE:HRI) is the most popular stock in this table. On the other hand National Energy Services Reunited Corp. (NASDAQ:NESR) is the least popular one with only 4 bullish hedge fund positions. Apellis Pharmaceuticals, Inc. (NASDAQ:APLS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on APLS as the stock returned 44.3% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.