We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Apellis Pharmaceuticals, Inc. (NASDAQ:APLS).

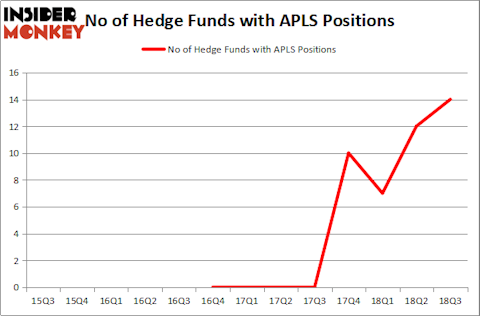

Apellis Pharmaceuticals, Inc. (NASDAQ:APLS) has seen an increase in support from the world’s most elite money managers of late. Our calculations also showed that APLS isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the new hedge fund action surrounding Apellis Pharmaceuticals, Inc. (NASDAQ:APLS).

What have hedge funds been doing with Apellis Pharmaceuticals, Inc. (NASDAQ:APLS)?

Heading into the fourth quarter of 2018, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from one quarter earlier. By comparison, 10 hedge funds held shares or bullish call options in APLS heading into this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Among these funds, Hillhouse Capital Management held the most valuable stake in Apellis Pharmaceuticals, Inc. (NASDAQ:APLS), which was worth $77 million at the end of the third quarter. On the second spot was Cormorant Asset Management which amassed $74.2 million worth of shares. Moreover, Sectoral Asset Management, Millennium Management, and RA Capital Management were also bullish on Apellis Pharmaceuticals, Inc. (NASDAQ:APLS), allocating a large percentage of their portfolios to this stock.

Consequently, key hedge funds were leading the bulls’ herd. BlueCrest Capital Mgmt., managed by Michael Platt and William Reeves, assembled the largest position in Apellis Pharmaceuticals, Inc. (NASDAQ:APLS). BlueCrest Capital Mgmt. had $0.2 million invested in the company at the end of the quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Apellis Pharmaceuticals, Inc. (NASDAQ:APLS) but similarly valued. These stocks are Coeur Mining, Inc. (NYSE:CDE), Douglas Dynamics Inc (NYSE:PLOW), Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM), and SurModics, Inc. (NASDAQ:SRDX). All of these stocks’ market caps match APLS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CDE | 13 | 57796 | 1 |

| PLOW | 6 | 7964 | -2 |

| RYTM | 15 | 208757 | 0 |

| SRDX | 13 | 200274 | -3 |

| Average | 11.75 | 118698 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $119 million. That figure was $255 million in APLS’s case. Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM) is the most popular stock in this table. On the other hand Douglas Dynamics Inc (NYSE:PLOW) is the least popular one with only 6 bullish hedge fund positions. Apellis Pharmaceuticals, Inc. (NASDAQ:APLS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard RYTM might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.