We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article, we look at what those funds think of Ameren Corporation (NYSE:AEE) based on that data.

Ameren Corporation (NYSE:AEE) shareholders have witnessed an increase in hedge fund interest in recent months. Overall hedge fund sentiment towards AEE is currently at its all time high. This is usually a very bullish signal. For example hedge fund sentiment in Xilinx Inc. (XLNX) was also at its all time high at the beginning of this year and the stock returned more than 46% in 2.5 months. We observed a similar performance from Progressive Corporation (PGR) which returned 27% and outperformed the SPY by nearly 14 percentage points in 2.5 months. Hedge fund sentiment towards IQVIA Holdings Inc. (IQV), Brookfield Asset Management Inc. (BAM), Atlassian Corporation Plc (TEAM), RCL, MTB and CRH hit all time highs at the end of December, and all of these stocks returned more than 20% in the first 2.5 months of this year.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s take a look at the recent hedge fund action surrounding Ameren Corporation (NYSE:AEE).

What does the smart money think about Ameren Corporation (NYSE:AEE)?

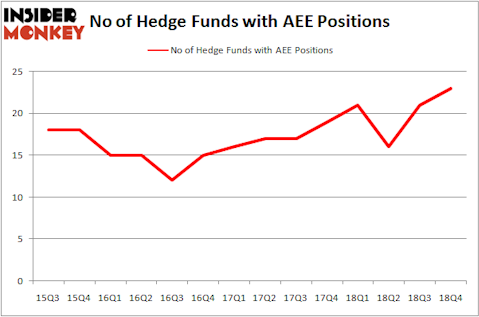

Heading into the first quarter of 2019, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, a change of 10% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in AEE over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons’s Renaissance Technologies has the biggest position in Ameren Corporation (NYSE:AEE), worth close to $316.8 million, comprising 0.3% of its total 13F portfolio. The second most bullish fund manager is AQR Capital Management, managed by Cliff Asness, which holds a $190.8 million position; 0.2% of its 13F portfolio is allocated to the company. Some other professional money managers that are bullish consist of Dmitry Balyasny’s Balyasny Asset Management, Israel Englander’s Millennium Management and John Overdeck and David Siegel’s Two Sigma Advisors.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Balyasny Asset Management, managed by Dmitry Balyasny, initiated the largest position in Ameren Corporation (NYSE:AEE). Balyasny Asset Management had $22.8 million invested in the company at the end of the quarter. Bruce Kovner’s Caxton Associates LP also initiated a $7.7 million position during the quarter. The other funds with brand new AEE positions are Michael Gelband’s ExodusPoint Capital, Ray Dalio’s Bridgewater Associates, and Joel Greenblatt’s Gotham Asset Management.

Let’s also examine hedge fund activity in other stocks similar to Ameren Corporation (NYSE:AEE). We will take a look at W.W. Grainger, Inc. (NYSE:GWW), Arista Networks Inc (NYSE:ANET), First Data Corporation (NYSE:FDC), and Barrick Gold Corporation (NYSE:ABX). This group of stocks’ market caps are similar to AEE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GWW | 23 | 260901 | -7 |

| ANET | 23 | 512906 | 1 |

| FDC | 52 | 2229916 | -9 |

| ABX | 36 | 792139 | 3 |

| Average | 33.5 | 948966 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.5 hedge funds with bullish positions and the average amount invested in these stocks was $949 million. That figure was $638 million in AEE’s case. First Data Corporation (NYSE:FDC) is the most popular stock in this table. On the other hand W.W. Grainger, Inc. (NYSE:GWW) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks Ameren Corporation (NYSE:AEE) is even less popular than GWW. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately AEE wasn’t in this group. Hedge funds that bet on AEE were disappointed as the stock returned 12.7% and underperformed the market by a small margin. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.