Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

W.R. Berkley Corporation (NYSE:WRB) shareholders have witnessed an increase in support from the world’s most elite money managers in recent months. Our calculations also showed that WRB isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s go over the key hedge fund action surrounding W.R. Berkley Corporation (NYSE:WRB).

How are hedge funds trading W.R. Berkley Corporation (NYSE:WRB)?

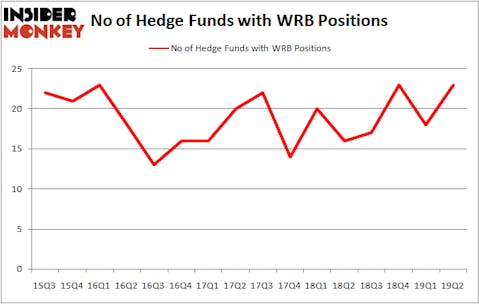

At Q2’s end, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 28% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards WRB over the last 16 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Brian Ashford-Russell and Tim Woolley’s Polar Capital has the most valuable position in W.R. Berkley Corporation (NYSE:WRB), worth close to $81.6 million, comprising 0.7% of its total 13F portfolio. Sitting at the No. 2 spot is Citadel Investment Group, led by Ken Griffin, holding a $55.1 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions encompass Cliff Asness’s AQR Capital Management, Israel Englander’s Millennium Management and Mario Gabelli’s GAMCO Investors.

With a general bullishness amongst the heavyweights, key money managers have been driving this bullishness. Laurion Capital Management, managed by Benjamin A. Smith, assembled the most valuable position in W.R. Berkley Corporation (NYSE:WRB). Laurion Capital Management had $2 million invested in the company at the end of the quarter. Perella Weinberg Partners also initiated a $1.3 million position during the quarter. The other funds with new positions in the stock are Richard Chilton’s Chilton Investment Company, Michael Gelband’s ExodusPoint Capital, and D. E. Shaw’s D E Shaw.

Let’s go over hedge fund activity in other stocks similar to W.R. Berkley Corporation (NYSE:WRB). These stocks are NVR, Inc. (NYSE:NVR), Centrais Eletricas Brasileiras S.A. – Eletrobras (NYSE:EBR), BanColombia S.A. (NYSE:CIB), and Brookfield Infrastructure Partners L.P. (NYSE:BIP). This group of stocks’ market values are similar to WRB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NVR | 27 | 971715 | 2 |

| EBR | 6 | 23900 | -2 |

| CIB | 10 | 159266 | -1 |

| BIP | 7 | 44941 | 0 |

| Average | 12.5 | 299956 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $300 million. That figure was $320 million in WRB’s case. NVR, Inc. (NYSE:NVR) is the most popular stock in this table. On the other hand Centrais Eletricas Brasileiras S.A. – Eletrobras (NYSE:EBR) is the least popular one with only 6 bullish hedge fund positions. W.R. Berkley Corporation (NYSE:WRB) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on WRB as the stock returned 9.7% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.