With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the second quarter. One of these stocks was Merus N.V. (NASDAQ:MRUS).

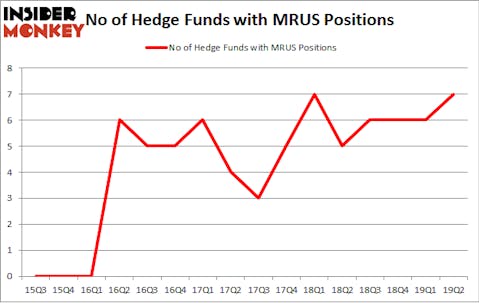

Is Merus N.V. (NASDAQ:MRUS) a buy right now? Hedge funds are getting more bullish. The number of bullish hedge fund bets inched up by 1 lately. Our calculations also showed that MRUS isn’t among the 30 most popular stocks among hedge funds (see the video below). MRUS was in 7 hedge funds’ portfolios at the end of June. There were 6 hedge funds in our database with MRUS positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike other investors who track every movement of the 25 largest hedge funds, our long-short investment strategy relies on hedge fund buy/sell signals given by the 100 best performing hedge funds. We’re going to take a gander at the new hedge fund action surrounding Merus N.V. (NASDAQ:MRUS).

How are hedge funds trading Merus N.V. (NASDAQ:MRUS)?

Heading into the third quarter of 2019, a total of 7 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from the previous quarter. By comparison, 5 hedge funds held shares or bullish call options in MRUS a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

More specifically, Biotechnology Value Fund / BVF Inc was the largest shareholder of Merus N.V. (NASDAQ:MRUS), with a stake worth $68 million reported as of the end of March. Trailing Biotechnology Value Fund / BVF Inc was Aquilo Capital Management, which amassed a stake valued at $20.4 million. Baker Bros. Advisors, Platinum Asset Management, and Athanor Capital were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, specific money managers have jumped into Merus N.V. (NASDAQ:MRUS) headfirst. Athanor Capital, managed by Parvinder Thiara, established the biggest position in Merus N.V. (NASDAQ:MRUS). Athanor Capital had $0.3 million invested in the company at the end of the quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Merus N.V. (NASDAQ:MRUS) but similarly valued. These stocks are Lydall, Inc. (NYSE:LDL), Macatawa Bank Corporation (NASDAQ:MCBC), Park Aerospace Corp. (NYSE:PKE), and AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG). This group of stocks’ market values are closest to MRUS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LDL | 12 | 20653 | 2 |

| MCBC | 5 | 23928 | 0 |

| PKE | 9 | 76335 | -1 |

| AMAG | 17 | 145204 | -2 |

| Average | 10.75 | 66530 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $67 million. That figure was $108 million in MRUS’s case. AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG) is the most popular stock in this table. On the other hand Macatawa Bank Corporation (NASDAQ:MCBC) is the least popular one with only 5 bullish hedge fund positions. Merus N.V. (NASDAQ:MRUS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on MRUS as the stock returned 21.6% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.