The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on December 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Endurance International Group Holdings Inc (NASDAQ:EIGI) based on those filings.

Endurance International Group Holdings Inc (NASDAQ:EIGI) investors should pay attention to an increase in enthusiasm from smart money of late. Our calculations also showed that EIGI isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most investors, hedge funds are assumed to be unimportant, old financial vehicles of yesteryear. While there are more than 8000 funds trading at the moment, Our researchers look at the leaders of this club, about 750 funds. These investment experts orchestrate the lion’s share of all hedge funds’ total asset base, and by keeping track of their top equity investments, Insider Monkey has formulated a number of investment strategies that have historically outstripped the market. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to analyze the key hedge fund action surrounding Endurance International Group Holdings Inc (NASDAQ:EIGI).

How are hedge funds trading Endurance International Group Holdings Inc (NASDAQ:EIGI)?

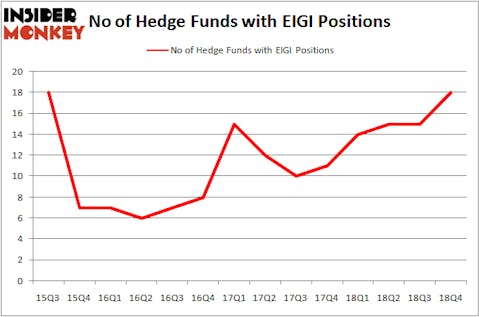

At Q4’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 20% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards EIGI over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Ahmet Okumus’s Okumus Fund Management has the number one position in Endurance International Group Holdings Inc (NASDAQ:EIGI), worth close to $80.3 million, comprising 15.1% of its total 13F portfolio. The second largest stake is held by Jim Simons of Renaissance Technologies, with a $21.7 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that are bullish consist of D. E. Shaw’s D E Shaw, Noam Gottesman’s GLG Partners and Joel Greenblatt’s Gotham Asset Management.

Consequently, key money managers were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, initiated the most outsized position in Endurance International Group Holdings Inc (NASDAQ:EIGI). Arrowstreet Capital had $0.9 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $0.5 million position during the quarter. The other funds with new positions in the stock are Mike Vranos’s Ellington, Minhua Zhang’s Weld Capital Management, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks similar to Endurance International Group Holdings Inc (NASDAQ:EIGI). We will take a look at New Mountain Finance Corp. (NYSE:NMFC), Tronox Holdings plc (NYSE:TROX), Easterly Government Properties Inc (NYSE:DEA), and Goosehead Insurance, Inc. (NASDAQ:GSHD). This group of stocks’ market valuations resemble EIGI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NMFC | 11 | 15280 | -1 |

| TROX | 26 | 144390 | -4 |

| DEA | 5 | 121754 | -3 |

| GSHD | 3 | 8605 | -1 |

| Average | 11.25 | 72507 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $73 million. That figure was $113 million in EIGI’s case. Tronox Holdings plc (NYSE:TROX) is the most popular stock in this table. On the other hand Goosehead Insurance, Inc. (NASDAQ:GSHD) is the least popular one with only 3 bullish hedge fund positions. Endurance International Group Holdings Inc (NASDAQ:EIGI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately EIGI wasn’t nearly as popular as these 15 stock and hedge funds that were betting on EIGI were disappointed as the stock returned -7.4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.