As we already know from media reports and hedge fund investor letters, many hedge funds lost money in fourth quarter, blaming macroeconomic conditions and unpredictable events that hit several sectors, with technology among them. Nevertheless, most investors decided to stick to their bullish theses and their long-term focus allows us to profit from the recent declines. In particular, let’s take a look at what hedge funds think about eHealth, Inc. (NASDAQ:EHTH) in this article.

Hedge fund interest in eHealth, Inc. (NASDAQ:EHTH) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as S.Y. Bancorp, Inc. (NASDAQ:SYBT), Compass Diversified Holdings (NYSE:CODI), and Revance Therapeutics Inc (NASDAQ:RVNC) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to view the new hedge fund action regarding eHealth, Inc. (NASDAQ:EHTH).

What have hedge funds been doing with eHealth, Inc. (NASDAQ:EHTH)?

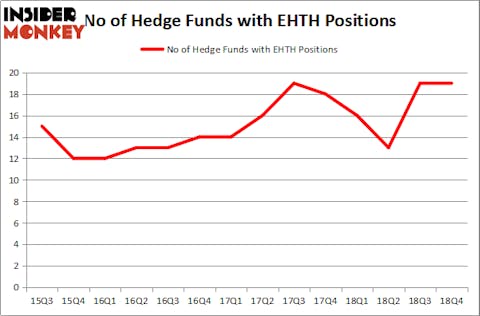

Heading into the first quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. By comparison, 16 hedge funds held shares or bullish call options in EHTH a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, OrbiMed Advisors held the most valuable stake in eHealth, Inc. (NASDAQ:EHTH), which was worth $42.3 million at the end of the fourth quarter. On the second spot was Redmile Group which amassed $41.9 million worth of shares. Moreover, Deerfield Management, PAR Capital Management, and Cannell Capital were also bullish on eHealth, Inc. (NASDAQ:EHTH), allocating a large percentage of their portfolios to this stock.

Judging by the fact that eHealth, Inc. (NASDAQ:EHTH) has experienced falling interest from the smart money, it’s safe to say that there were a few funds who sold off their positions entirely last quarter. It’s worth mentioning that David Park’s Headlands Capital cut the largest stake of the 700 funds tracked by Insider Monkey, valued at close to $2.3 million in stock, and Adam Usdan’s Trellus Management Company was right behind this move, as the fund dropped about $0.6 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to eHealth, Inc. (NASDAQ:EHTH). These stocks are S.Y. Bancorp, Inc. (NASDAQ:SYBT), Compass Diversified Holdings LLC (NYSE:CODI), Revance Therapeutics Inc (NASDAQ:RVNC), and Apellis Pharmaceuticals, Inc. (NASDAQ:APLS). All of these stocks’ market caps resemble EHTH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SYBT | 6 | 9598 | -3 |

| CODI | 4 | 3605 | 0 |

| RVNC | 9 | 27020 | -2 |

| APLS | 17 | 171412 | 3 |

| Average | 9 | 52909 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $53 million. That figure was $240 million in EHTH’s case. Apellis Pharmaceuticals, Inc. (NASDAQ:APLS) is the most popular stock in this table. On the other hand Compass Diversified Holdings LLC (NYSE:CODI) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks eHealth, Inc. (NASDAQ:EHTH) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on EHTH as the stock returned 49.5% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.