We at Insider Monkey have gone over 730 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of June 28th. In this article, we look at what those funds think of Cohen & Steers, Inc. (NYSE:CNS) based on that data.

Is Cohen & Steers, Inc. (NYSE:CNS) going to take off soon? Hedge funds are in an optimistic mood. The number of bullish hedge fund positions rose by 6 lately. Our calculations also showed that CNS isn’t among the 30 most popular stocks among hedge funds (view the video below). CNS was in 15 hedge funds’ portfolios at the end of June. There were 9 hedge funds in our database with CNS holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to check out the new hedge fund action regarding Cohen & Steers, Inc. (NYSE:CNS).

What does smart money think about Cohen & Steers, Inc. (NYSE:CNS)?

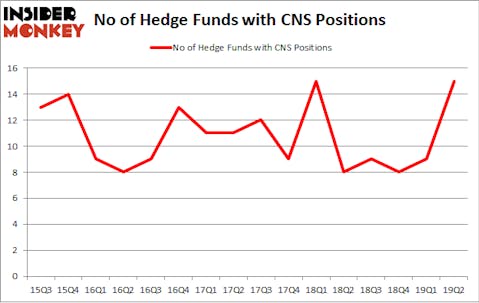

Heading into the third quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 67% from the previous quarter. The graph below displays the number of hedge funds with bullish position in CNS over the last 16 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Mario Gabelli’s GAMCO Investors has the largest position in Cohen & Steers, Inc. (NYSE:CNS), worth close to $41.7 million, amounting to 0.3% of its total 13F portfolio. The second largest stake is held by Royce & Associates, managed by Chuck Royce, which holds a $16.4 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions include Renaissance Technologies, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and John Overdeck and David Siegel’s Two Sigma Advisors.

As industrywide interest jumped, some big names were leading the bulls’ herd. Two Sigma Advisors, managed by John Overdeck and David Siegel, created the biggest position in Cohen & Steers, Inc. (NYSE:CNS). Two Sigma Advisors had $1.6 million invested in the company at the end of the quarter. David Harding’s Winton Capital Management also made a $0.9 million investment in the stock during the quarter. The following funds were also among the new CNS investors: D. E. Shaw’s D E Shaw, Michael Gelband’s ExodusPoint Capital, and Hoon Kim’s Quantinno Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Cohen & Steers, Inc. (NYSE:CNS). We will take a look at International Bancshares Corporation (NASDAQ:IBOC), Itron, Inc. (NASDAQ:ITRI), Yamana Gold Inc. (NYSE:AUY), and American Equity Investment Life Holding Company (NYSE:AEL). All of these stocks’ market caps are similar to CNS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IBOC | 18 | 147617 | 4 |

| ITRI | 22 | 483411 | 7 |

| AUY | 18 | 120611 | 0 |

| AEL | 17 | 89771 | 0 |

| Average | 18.75 | 210353 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $210 million. That figure was $69 million in CNS’s case. Itron, Inc. (NASDAQ:ITRI) is the most popular stock in this table. On the other hand American Equity Investment Life Holding Company (NYSE:AEL) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Cohen & Steers, Inc. (NYSE:CNS) is even less popular than AEL. Hedge funds clearly dropped the ball on CNS as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on CNS as the stock returned 7.5% during the third quarter and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.