While the market driven by short-term sentiment influenced by uncertainty regarding the future of the interest rate environment in the US, declining oil prices and the trade war with China, many smart money investors kept their optimism regarding the current bull run in the fourth quarter, while still hedging many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Cohen & Steers, Inc. (NYSE:CNS).

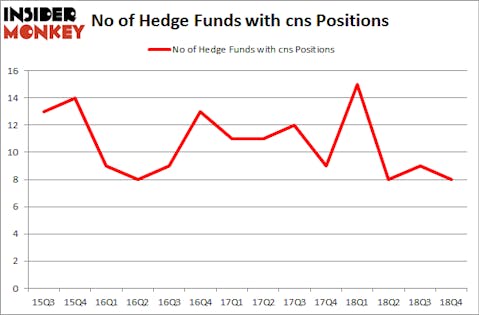

Cohen & Steers, Inc. (NYSE:CNS) has experienced a decrease in activity from the world’s largest hedge funds lately. CNS was in 8 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 9 hedge funds in our database with CNS holdings at the end of the previous quarter. Our calculations also showed that cns isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s view the new hedge fund action regarding Cohen & Steers, Inc. (NYSE:CNS).

What does the smart money think about Cohen & Steers, Inc. (NYSE:CNS)?

At the end of the fourth quarter, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of -11% from the second quarter of 2018. By comparison, 15 hedge funds held shares or bullish call options in CNS a year ago. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in Cohen & Steers, Inc. (NYSE:CNS) was held by GAMCO Investors, which reported holding $30.1 million worth of stock at the end of December. It was followed by Royce & Associates with a $11.4 million position. Other investors bullish on the company included Renaissance Technologies, Millennium Management, and AQR Capital Management.

Judging by the fact that Cohen & Steers, Inc. (NYSE:CNS) has faced falling interest from the aggregate hedge fund industry, it’s safe to say that there were a few money managers that slashed their entire stakes last quarter. Intriguingly, Ken Griffin’s Citadel Investment Group cut the largest stake of the “upper crust” of funds monitored by Insider Monkey, worth close to $1.2 million in stock. Brandon Haley’s fund, Holocene Advisors, also dumped its stock, about $0.4 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 1 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Cohen & Steers, Inc. (NYSE:CNS). We will take a look at Avaya Holdings Corp. (NYSE:AVYA), Sibanye Gold Ltd (NYSE:SBGL), Forward Air Corporation (NASDAQ:FWRD), and Universal Forest Products, Inc. (NASDAQ:UFPI). All of these stocks’ market caps match CNS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVYA | 36 | 353504 | 2 |

| SBGL | 12 | 37299 | 0 |

| FWRD | 11 | 69939 | -4 |

| UFPI | 16 | 43942 | -2 |

| Average | 18.75 | 126171 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $126 million. That figure was $47 million in CNS’s case. Avaya Holdings Corp. (NYSE:AVYA) is the most popular stock in this table. On the other hand Forward Air Corporation (NASDAQ:FWRD) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Cohen & Steers, Inc. (NYSE:CNS) is even less popular than FWRD. Hedge funds clearly dropped the ball on CNS as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on CNS as the stock returned 41.7% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.