The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing more than 730 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of June 28th, 2019. What do these smart investors think about Cardtronics plc (NASDAQ:CATM)?

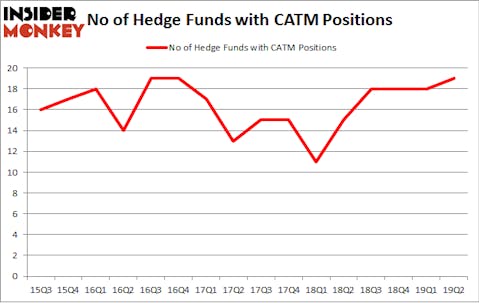

Cardtronics plc (NASDAQ:CATM) has experienced an increase in enthusiasm from smart money of late. CATM was in 19 hedge funds’ portfolios at the end of June. There were 18 hedge funds in our database with CATM positions at the end of the previous quarter. Our calculations also showed that CATM isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a lot of tools shareholders put to use to evaluate their stock investments. Two of the most useful tools are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the elite fund managers can outperform the market by a solid amount (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s check out the new hedge fund action regarding Cardtronics plc (NASDAQ:CATM).

What have hedge funds been doing with Cardtronics plc (NASDAQ:CATM)?

Heading into the third quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from one quarter earlier. By comparison, 15 hedge funds held shares or bullish call options in CATM a year ago. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

The largest stake in Cardtronics plc (NASDAQ:CATM) was held by Hudson Executive Capital, which reported holding $222 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $31.2 million position. Other investors bullish on the company included D E Shaw, Arrowstreet Capital, and GLG Partners.

As industrywide interest jumped, key money managers were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, assembled the biggest position in Cardtronics plc (NASDAQ:CATM). Marshall Wace LLP had $1.8 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $0.4 million investment in the stock during the quarter. The following funds were also among the new CATM investors: Benjamin A. Smith’s Laurion Capital Management and Minhua Zhang’s Weld Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Cardtronics plc (NASDAQ:CATM) but similarly valued. We will take a look at Saul Centers Inc (NYSE:BFS), Herc Holdings Inc. (NYSE:HRI), Accelerate Diagnostics Inc (NASDAQ:AXDX), and Altus Midstream Company (NASDAQ:ALTM). This group of stocks’ market caps match CATM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BFS | 9 | 41006 | -1 |

| HRI | 22 | 550489 | -6 |

| AXDX | 10 | 65894 | -1 |

| ALTM | 7 | 20619 | 1 |

| Average | 12 | 169502 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $170 million. That figure was $332 million in CATM’s case. Herc Holdings Inc. (NYSE:HRI) is the most popular stock in this table. On the other hand Altus Midstream Company (NASDAQ:ALTM) is the least popular one with only 7 bullish hedge fund positions. Cardtronics plc (NASDAQ:CATM) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on CATM as the stock returned 10.7% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.