“Since 2006, value stocks (IVE vs IVW) have underperformed 11 of the 13 calendar years and when they beat growth, it wasn’t by much. Cumulatively, through this week, it has been a 122% differential (up 52% for value vs up 174% for growth). This appears to be the longest and most severe drought for value investors since data collection began. It will go our way eventually as there are too many people paying far too much for today’s darlings, both public and private. Further, the ten-year yield of 2.5% (pre-tax) isn’t attractive nor is real estate. We believe the value part of the global equity market is the only place to earn solid risk adjusted returns and we believe those returns will be higher than normal,” said Vilas Fund in its Q1 investor letter. We aren’t sure whether value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on Public Service Enterprise Group Incorporated (NYSE:PEG) in order to identify whether reputable and successful top money managers continue to believe in its potential.

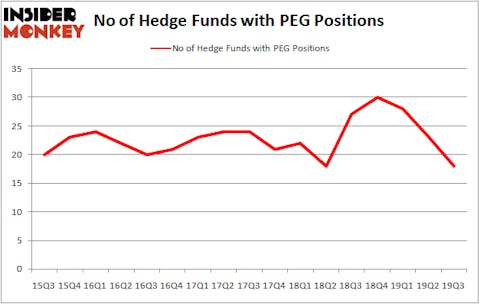

Public Service Enterprise Group Incorporated (NYSE:PEG) investors should be aware of a decrease in hedge fund sentiment recently. PEG was in 18 hedge funds’ portfolios at the end of September. There were 23 hedge funds in our database with PEG holdings at the end of the previous quarter. Our calculations also showed that PEG isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Matthew Hulsizer of PEAK6 Capital

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s review the recent hedge fund action surrounding Public Service Enterprise Group Incorporated (NYSE:PEG).

What does smart money think about Public Service Enterprise Group Incorporated (NYSE:PEG)?

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a change of -22% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards PEG over the last 17 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Stuart J. Zimmer’s Zimmer Partners has the largest position in Public Service Enterprise Group Incorporated (NYSE:PEG), worth close to $284.9 million, accounting for 3.1% of its total 13F portfolio. On Zimmer Partners’s heels is AQR Capital Management, led by Cliff Asness, holding a $149 million position; 0.2% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors that hold long positions comprise Phill Gross and Robert Atchinson’s Adage Capital Management, Renaissance Technologies and John Overdeck and David Siegel’s Two Sigma Advisors. In terms of the portfolio weights assigned to each position Ecofin Ltd allocated the biggest weight to Public Service Enterprise Group Incorporated (NYSE:PEG), around 5.12% of its 13F portfolio. Zimmer Partners is also relatively very bullish on the stock, setting aside 3.1 percent of its 13F equity portfolio to PEG.

Seeing as Public Service Enterprise Group Incorporated (NYSE:PEG) has faced falling interest from hedge fund managers, we can see that there lies a certain “tier” of hedgies that slashed their positions entirely last quarter. At the top of the heap, Michael Gelband’s ExodusPoint Capital dumped the biggest investment of the “upper crust” of funds monitored by Insider Monkey, totaling close to $9.1 million in stock, and Michael Kharitonov and Jon David McAuliffe’s Voleon Capital was right behind this move, as the fund dropped about $5.5 million worth. These transactions are interesting, as total hedge fund interest fell by 5 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Public Service Enterprise Group Incorporated (NYSE:PEG) but similarly valued. These stocks are Consolidated Edison, Inc. (NYSE:ED), TE Connectivity Ltd. (NYSE:TEL), Newmont Goldcorp Corp (NYSE:NEM), and Canadian Pacific Railway Limited (NYSE:CP). This group of stocks’ market values are similar to PEG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ED | 22 | 1396380 | -4 |

| TEL | 30 | 1265055 | 3 |

| NEM | 41 | 868131 | 0 |

| CP | 31 | 1781495 | 1 |

| Average | 31 | 1327765 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31 hedge funds with bullish positions and the average amount invested in these stocks was $1328 million. That figure was $839 million in PEG’s case. Newmont Goldcorp Corp (NYSE:NEM) is the most popular stock in this table. On the other hand Consolidated Edison, Inc. (NYSE:ED) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Public Service Enterprise Group Incorporated (NYSE:PEG) is even less popular than ED. Hedge funds dodged a bullet by taking a bearish stance towards PEG. Our calculations showed that the top 20 most popular hedge fund stocks returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately PEG wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); PEG investors were disappointed as the stock returned -4.5% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.